Sector ETFs provide exposure to a specific industry or market sector and have grown in popularity amongst “Do It Yourself” investors who are looking to add strategic or tactical opportunities to their investment portfolios.

Why ETFs for Sector Exposures?

Sector ETFs have many benefits that ETFs provide in general: diversity, transparency, liquidity, and cost efficiency. Using a sector ETF, investors can tactically add exposure to an entire sector within a single trade. A sector ETF generally holds anywhere from 10 to over 100 different securities providing instant diversification which minimizes single stock risk and maximizes exposure to the entire sector. This diversification also helps to lower overall portfolio volatility

Sector ETFs in Canada:

Canada has over 1100 ETFs and 150 of these are categorized as sector ETFs. BMO ETFs has 20 different sector ETFs and was one of the first to list sector ETFs on the TSX in 2009.

ZMT BMO Equal Weight Global Base Metals Hedged to CAD Index ETF

Listed October 20, 2009

ZEB BMO Equal Weight Banks Index ETF

Listed October 20, 2009

ZEO BMO Equal Weight Oil & Gas Index ETF

Listed October 20, 2009

ZUT BMO Equal Weight Utilities Index ETF

Listed January 19, 2010

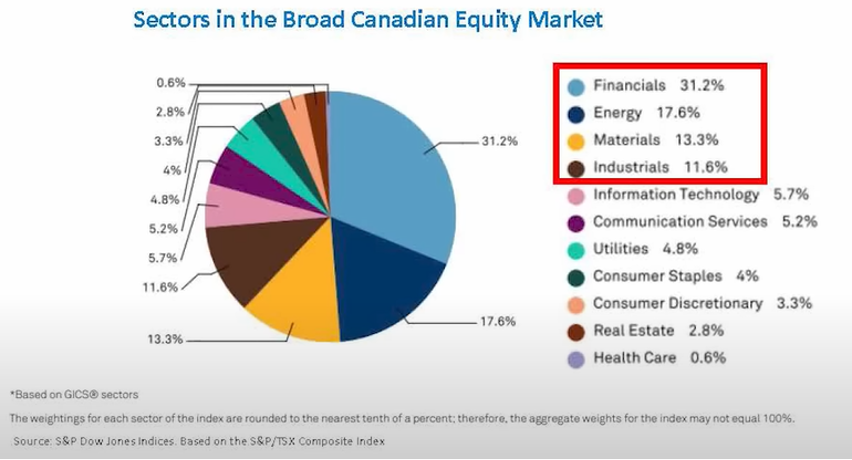

The Canadian market is very concentrated in several different sectors: Financials, Energy, Industrials and Materials. For investors using a broad market Canadian ETF they may be underexposed to other areas of the market. For example, the Health Care and Info Tech sectors in Canada are extremely small relative to the global economy. Therefore Canadian investors may consider U.S. and global sectors for a more diversified portfolio. This completion trade makes sector ETFs in Canada very popular.

Investors may also use sector ETFs because they like certain characteristics that some sectors exhibit. For example, Canadian investors who are more defensive may prefer areas that are more stable, paying income or dividends. So, sectors like Financials, Real Estate, and Utilities tend to resonate with them.

Equal Weight vs. Market Capitalization Weighted:

There are typically two ways in which sector ETFs can be constructed: Market cap weighted and Equal weighted. Market cap weights all the stocks in the ETF’s portfolio based on the market size of the company, so a larger company will have a larger overall position in the portfolio. This weighting method provides more single stock exposure to the companies with the largest market caps. A consideration here is that this method can be concentrated in certain securities which have outsized market caps vs their peers.

Equal Weighed weights all the companies equally in a portfolio. This approach is an effective strategy for reducing single stock risk. It can help mitigate individual security concentration and provide better overall diversification to sector exposures. Because the largest companies are given the same weight as smaller companies, this method also tilts the portfolio slightly more to mid and small cap exposures.

Sectors & The Market Cycle:

A popular way that sector ETFs are used by investors is to employ a sector rotation strategy based on the economic cycle. Fluctuations within an economic cycle consists of contraction (recession) and expansion (growth). Within a market cycle defensive sectors (Utilities, Consumer Staples) tend to perform well during recession and economic troughs and cyclical sectors (Financials, Industrials, and Information Tech) tend to do well when the economy is expanding. Therefore, using sector ETFs to rotate into relevant sectors helps some investors play the economic cycle.

Today’s Market Environment and its Impact on Sectors:

Investors have been faced with a drastic market rotation out of growth stocks and into value over the past 12 months. We are also seeing inflation and interest rates rising quickly. This environment has impacted each sector differently:

- Tech Sector: Rising rates put pressure on growth sectors like tech stocks which are priced based on future earnings. Higher rates discount these earnings more aggressively which causes current valuations to drop.

- Energy: Energy was the top performing sector in 2021 and has been the top performing sector so far in 2022. Energy tends to be more insulated against interest rates and rising inflation and has benefitted from the increase in the price of oil this year.

- Banks: Banks benefit from a rising rate environment because they can make wider spreads on loans.

- Utilities: Utility stocks are more defensive and have higher dividend yields than other sectors.

For more information on this topic, please visit our YouTube channel – ETF Market Insights to watch our Spring into ETF Investing Episode on Sectors (episode 4)

Click here to watch now.

DISCLAIMER:

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.