What are Sector ETFs?

Sector ETFs allow targeted exposure to sectors or industries like financials, materials, or information technology – domestic, regional, or global. The sectors are usually classified according to the Global Industry Classification Standard (GICS), but other classifications can also be used. While sector ETFs could be active funds, most track an index, offering transparency, liquidity, and low fees.

There are eleven broad GICS sectors that can be invested in with sector ETFs.

1) Energy

2) Materials

3) Industrials

4) Consumer Discretionary

5) Utilities

6) Real Estate

7) Communication Services

8) Financials

9) Health Care

10) Consumer Staples

11) Information Technology

There are two common approaches in constructing a sector portfolio: market capitalization weighted and equal weighted. As the names suggest, the former approach weights securities in the portfolio by market capitalization while the latter weights them equally.

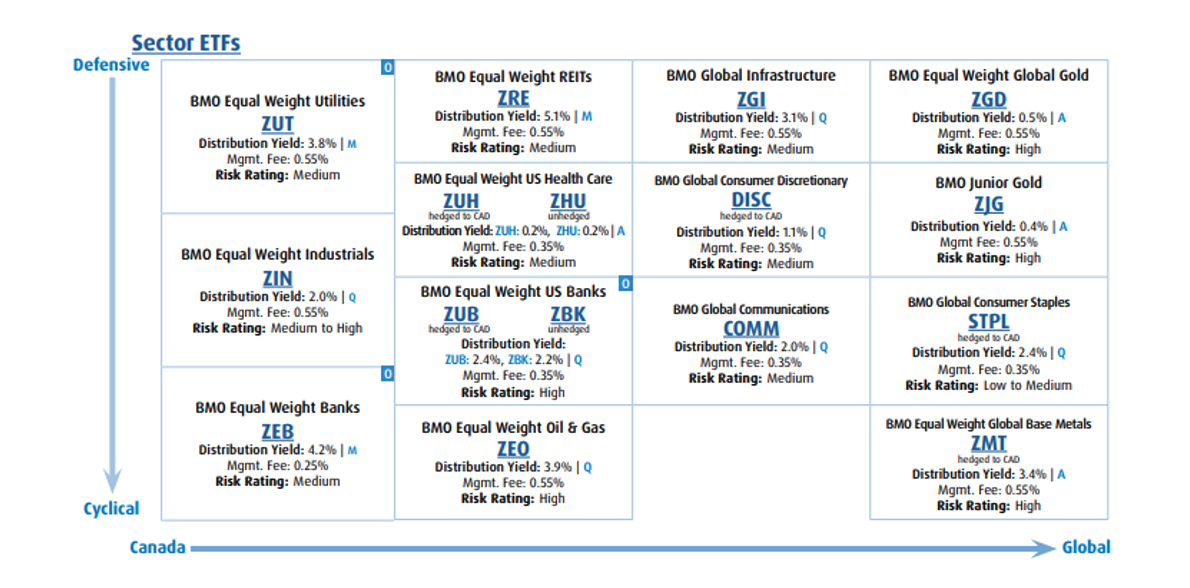

At BMO ETFs, our suite of sector ETFs covers equal-weighted and market-weighted strategies across all sectors, locally and globally. We opt for equal-weighted strategies for sectors that have the potential to get concentrated in a few large names with the market-capitalization approach, ensuring effective diversification and mitigating individual company risk.

Source: BMO GAM, BMO ETF Roadmap February 2023 (Visit ETF Centre – CA EN INVESTORS (bmogam.com)

Annualized Distribution Yield: The most recent regular distribution, or expected distribution, (excluding additional year end distributions) annualized for frequency, divided by current NAV.

Risk is defined as the uncertainty of return and the potential for capital loss in your investments.

Why Invest in Sector ETFs?

Sector ETFs can offer differentiated return and risk profiles for investors, not only from broad market portfolios but also from other sectors. Additionally, investing in a sector ETF allows access to a broad range of companies that have businesses that operate in similar or related industries, which can be more diversified than investing in a single stock. The investor does not have to place individual bets on single companies, which helps limit company-specific risks.

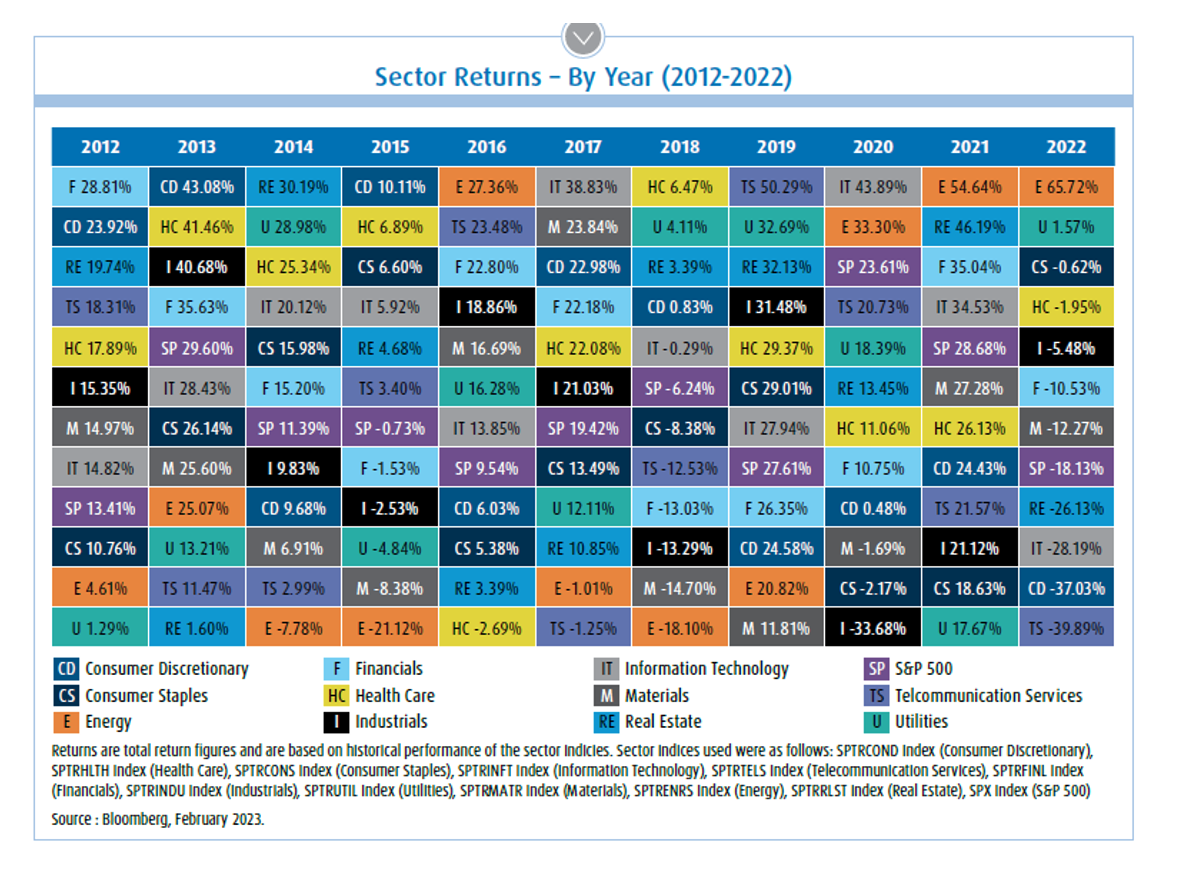

The table above shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

Playing Defense – Sector Rotation Strategies

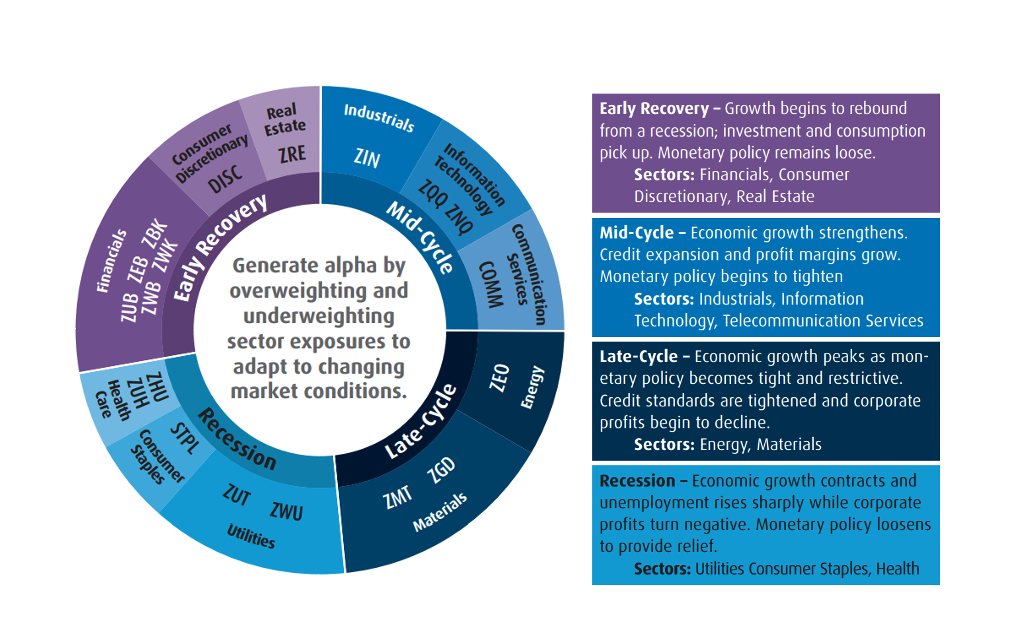

The business or economic cycle refers to a cycle of expansion and contraction that economies undergo, accompanied by similar upswings and downswings in economic output and employment. The business cycle can then be categorized in four broad stages – early recovery, mid-cycle, late-cycle, and recession. While the economy can experience shocks like the COVID pandemic that disrupt activity, the economy can generally be put into one of the four phases at any given time. Each stage produces different sector winners and losers.

Source: BMO Global Asset Management. For illustrative purposes only.

Source: BMO Global Asset Management. For illustrative purposes only.

Alpha: A measure of performance often considered the active return on an investment. It gauges the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

The visuals above sketch out a framework for sector rotation strategies. With economic growth slowing down and a potential recession on the horizon, defensive strategies may be better positioned to outperform. Investors can thus overweight sectors like utilities, consumer staples and health care sectors to play defense.

While tough macroeconomic conditions can weigh down most companies, firms in defensive sectors benefit from resilient earnings. Poor or negative growth impacts the earnings of pro-cyclical companies more so as consumers clamp down on spending. However, spending on utilities, consumer staples and health care – so called necessities – remains relatively stable. As a result, the divergence in earnings can create an opportunity to overweight and underweight sectors tactically.

Tactically trading sectors can lead to higher volatility, especially compared to diversified, broad market portfolios. There can also be underlying factors in a sector that can offset tailwinds from macroeconomic conditions. For instance, new government regulation can disrupt earnings in the financial sector despite the economy entering the early recovery stage.

DISCLAIMER:

*Management Expense Ratios (MERs) are the audited MERs as of the fund’s fiscal year end or an estimate if the fund is less than one year old since the audited MER of the ETF has not gone through a financial reporting period.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF . BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.