One of the most common questions we get from investors is, “If a certain ETF doesn’t trade often, or has low trading volume, will I be able to sell the ETF when I need to?” The quick answer is yes you can, and I’ll explain why.

This liquidity concern makes sense when we think about trading stocks. A stock which is thinly traded will be much less liquid than a large cap, blue chip stock. Therefore, the less liquid stock could be difficult to sell if there is not demand for it.

However, ETFs work differently than stocks in this way. The true liquidity of an ETF has three layers. These three layers are something we can’t easily see. In fact, most volume data available to investors online is only showing the tip of the liquidity iceberg.

- Natural Liquidity: Buyer < > Seller

The first layer that most investors are familiar with is between the natural buyer and the natural seller, who get matched on the exchange. Think of this like going to Facebook Marketplace or Kijiji to sell your car. These marketplaces will match a buyer with a seller. Both will agree on a predetermined price and the transaction is made. This layer of liquidity is mostly present among the largest and most liquid ETFs in the market (usually those with a billion or more in assets). - Market Makers: Buyer < > Market Maker < > Seller

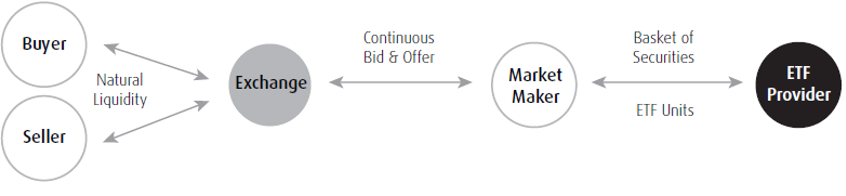

The second layer of liquidity uses market makers. Marker makers are dealers or brokers who hold an inventory of ETFs and will either buy ETFs or sell ETFs depending on supply and demand. A market maker is trade agnostic which means they are always willing to buy and sell; they make their money in trading volumes (earning commissions on each trade). This would be like going to a car dealership to buy or sell a car. The dealer acts as a market maker, who will buy your car and sell to someone else, and they usually earn a spread on this transaction. Market makers are often who you will “meet” on the other end of your ETF trades and they play a huge part in a healthy and liquid ETF ecosystem! - Creations & Redemptions: ETF Provider > Buyer or Seller > ETF Provider

The third layer of liquidity is called the Creation and Redemption Process. ETFs have this ability because they are open-ended funds. The process occurs when there is an imbalance in supply or demand for a specific ETF. If demand is high, there will be more creations. This means the ETF provider (for example, BMO ETFs) will create more shares of an ETF to match demand. This is simply done by purchasing the stocks that the ETF holds, turning it into an ETF, and then passing it on to the buyer. If supply is high and demand is low, there will be more redemptions. This means that the seller will send their ETF back to the ETF provider, the provider will disassemble it and sell the underlying stocks in the market, sending cash back to the ETF seller. Think of this process like ordering a car directly from the auto manufacturer; they will go and buy all the parts for the vehicle, build it, and deliver you the car. A redemption would be the opposite where a car would be sold back to the auto plant and disassembled and sold off for parts (this is of course not how things are done in the auto world but a good example to visualize the process!). This last layer of liquidity is important to understand because it demonstrates that an ETF is as liquid as its underlying holdings of stocks or bonds.

Because of these three layers of liquidity, an ETF can sometimes be more liquid than its underlying holdings. We typically see this in less liquid asset classes such as preferred shares and fixed income, where the ETF will be easier to trade than the underlying holdings. Therefore, the increased liquidity is just another of the many benefits of using ETFs in your portfolio!

Did You Know?

The Toronto Stock Exchange (TSX) is just one of six different exchanges in Canada where ETFs trade every day. In fact, only about 35%1 of all ETF trading volume trades through the TSX. However, when looking at ETF volume metrics online, many stats published are only capturing the TSX data which means about 65% of the total trading volumes are not being accounted for. Therefore, look to get quotes and volume stats from sites with more robust data sets such as quotemedia.com. A quote which shows an ETF’s trading volume on all the stock exchanges is called a consolidated quote.

1Source: Neo Exchange, July 2021.

To learn more on this topic, check out our ETF Market Insights Episode on ETF Liquidity and Market Makers.

Click here to watch now.

DISCLAIMER:

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.