When one hears the term ‘American exceptionalism’, for some investors, the first images that come to mind are perhaps that of a certain President-elect and his inclinations towards jingoism. But the usage of the term outside of the U.S. has intensified of late, particularly when it comes to markets.

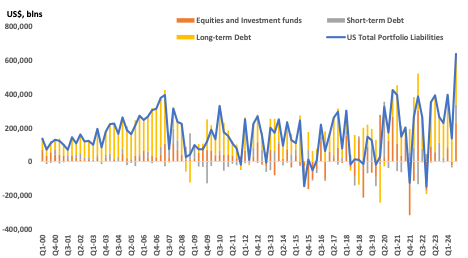

Indeed, more than any other time in modern history, the U.S. markets are benefitting from a strong influx of foreign capital (Chart 1). The impact has been profound, with U.S. equity market valuations now at levels that go beyond what is generally thought reasonable, while the U.S. dollar (USD) is trading close to two-year highs. Within the leading global equity index, the U.S. accounts for almost 70% of the weight, well over double where things stood a few decades ago.

Chart 1 – U.S. Attracts More Foreign Capital Than Any Other Point in History

Source: BEA, BMO Global Asset Management, as of December 31, 2024.

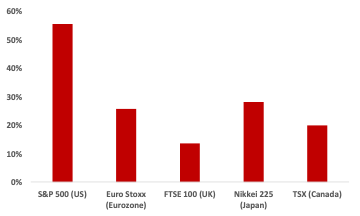

Chart 2 – Two-Year Price Return of Selected Equity Indices

*In USD terms, prices only. Source: BMO Global Asset Management, as of December 31, 2024.

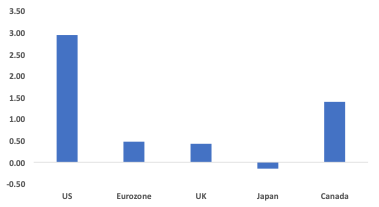

Now, there are several easily digestible reasons why the U.S. market continues to capture the hearts and minds of investors worldwide. To start, U.S. economic fundamentals remain sound, with flexible labour and deep capital markets combining to deliver an enviable track record of productivity. That’s directly helped generate impressive earnings for American companies. Additionally, lower debt levels among U.S. households (compared to other developed markets) buttress a strong propensity to consume. As such, the U.S. economy has expanded by an average of just under 3% year-over-year (YoY) over the past four quarters – even with interest rates not far off generational highs.

Chart 3 – Average Real Growth by Economy (Past Four Quarters, Year-Over-Year)

Source: BMO Global Asset Management Q3 2023-Q3 2024

Those sorts of fundamentals form the bedrock of why the U.S. continues to draw in foreign capital. From the eyes of global investors, Japanese and European markets offer too low of a yield, with political risk for the latter becoming more of a risk going forward. Meanwhile, authorities in China appear bent on moving forward with deleveraging in the real estate sector and at the regional government level. That means the necessary stimulus to prop up Chinese consumption will likely be done piecemeal and via monetary policy. Elsewhere, while some Emerging Markets (EM) may still offer relatively attractive yields, the risk profile looks very different as inflation threats linger and the world’s largest buyer of EM goods (the U.S.) becomes more insular. And we haven’t even mentioned the liquidity of U.S. assets – which becomes very attractive during volatile periods. Add it all up, and the risk/return profile in the U.S. looks far better than it does in any other country.

4 Reasons to Reorient Exposures

However, having said the above, the coast is not all clear for another banner year for U.S. assets. Instead, we see strong enough arguments that tell us that U.S. assets shouldn’t perform to the same degree that they have over the past few years. Being less enthusiastic about the theme of ‘U.S. exceptionalism’ means that we will be orienting our strategy for the coming year away from index plays and towards alternative investments and structured outcomes that are tailored towards generating cashflow. There are many reasons why we think this will be the optimal strategy to pursue.

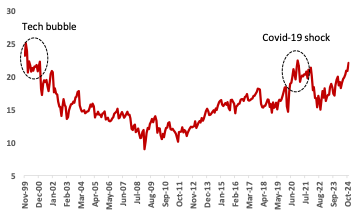

The first is valuation. Certainly, this topic has gotten a lot of airplay already, but it’s worth going over the finer points at least one more time here. For the S&P 500, consensus estimates have large cap earnings expanding by around 10%1 – but at the same time, the forward price-to-earnings (P/E) ratio is already at highs not seen since 2020. Assuming that the long-term relationship between nominal GDP growth and earnings holds, we see earnings growth next year closer to 6-7%—implying that our own estimate of forward P/E is actually closer to extremes last seen around 2000 (or the ‘dot com’ bubble).2 Again, this isn’t a clarion call to move out of broad risk on its own, but it does make us less enthusiastic about adding at the very least.

Chart 4 – S&P 500 Forward P/E Ratio Over Time

Source: BMO Global Asset Management, as of November 30, 2024.

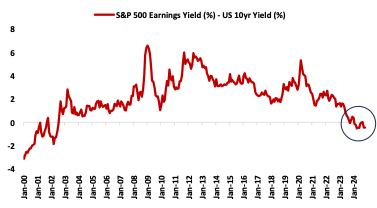

Second, the shift higher in long-end U.S. Treasury (UST) yields could portend increased market risks. Since the inaugural rate cut from the U.S. Federal Reserve for this cycle in September, the 10-year yield has shifted higher by over 90 basis points (bps). That’s atypical behaviour that likely speaks to the view that the U.S. will be issuing more debt over the long-term and/or that the market views equilibrium growth levels in the U.S. as being higher than before. Regardless of which narrative is driving this, the simple takeaway here is that we’re in an environment where the U.S. 10-year yield is now above the earnings yield for the S&P 500. The last time this was a frequent occurrence was around the turn of the century – when the S&P 500 struggled to generate much in the way of momentum. Once more, this isn’t a sign of the apocalypse. Nevertheless, it does tell us that interest to diversify across the spectrum of U.S. assets should increase (away from equities and into bonds) as UST offer a better risk/return profile than equities do.

Chart 5 – U.S. 10-Year Yield is Higher Than the Earnings Yield of the S&P 500

Source: BMO Global Asset Management, as of December 31, 2024.

The third reason is President-elect Trump. More specifically, it’s about revenue and spending plans over the course of his term. Unlike the start of his first term, Trump is being handed a massive deficit (over 6%), and yet he is still expected to push through tax cuts for corporates – including an extension of the prior tax cuts under the Tax Cuts and Jobs Act of 2018. For markets, the pertinent problem here is how these will be funded—Trump’s claims that it will be through tariffs hardly seem viable. It may not seem like it now, but fiscal discipline is still important and markets will eventually punish any lack of effort to address this via long-end UST yields, which we’ve somewhat seen since September.

And when it comes to trimming the deficit, there’s a lot of hope being placed on the ability of a proposed advisory committee (DOGE) to cut wasteful spending. However, when you comb through the numbers there’s actually very little that can be trimmed without curbing defense or mandatory (Social Security, Medicare and Medicaid) expenditures. Additionally, DOGE is an advisory body with little actual ability to push change through Congress on their own. This is an important wrinkle – and one that we don’t think markets are pricing in appropriately.

Finally, the fourth reason is a simple one to conceptualize and related to the first. The theme of U.S. exceptionalism might just be in the price already. The widening gap in fundamentals between the U.S. and the rest of the world is an easily digestible story that the market has been chewing on for some time now. The real surprise will be when that story changes and the gap begins to narrow, a theme that the market could run with for some time. There are several potential catalysts to watch for here—including fiscal stimulus in China targeted at domestic consumption, or a turnaround in the German business cycle led by pledges of more government spending (effectively, a removal of the debt brake there).

To conclude, this isn’t an exercise to convince anyone that there’s a potential bubble in U.S. markets. Again, we still see compelling reasons to remain invested. Nevertheless, we’re recalibrating our strategy to be in line with a more ‘cautiously optimistic’ outlook. That means veering away from index plays and towards alternative investments and structured outcomes that are tailored towards generating cashflow. As such, we’ll be complementing or curbing exposure to broad index trackers, with high dividend and covered call strategies. These include the BMO US High Dividend Covered Call ETF (Ticker: ZWH), the BMO Covered Call Utilities ETF (Ticker: ZWU), and the BMO Covered Call US Banks ETF (Ticker: ZWK).

Additionally, given where current valuations are, protecting downside risks to core exposures that track U.S. large caps is essential. The ETF market offers plenty of ‘liquid alternative’ investing strategies that can help protect downside risks while still allowing some topside participation. However, BMO’s suite of ‘Buffer ETFs’ are particularly well placed to do that with their quarterly resets offering much more flexibility. As such, we will be increasing our allocation to the BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN).

Performance (%)

| Year-to-Date | 1-Month | 3-Month | 6-Month | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception | |

| ZWH | 22.01 | 3.35 | 7.10 | 11.63 | 22.93 | 10.18 | 9.63 | 10.48 | 11.33 |

| ZWU | 16.29 | 1.79 | 4.72 | 11.33 | 18.69 | 4.61 | 3.57 | 4.00 | 4.81 |

| ZWK | 48.88 | 11.61 | 18.63 | 29.66 | 58.91 | 1.48 | 4.36 | – | 5.98 |

| ZJAN | Returns not available as there is less than one year’s performance data. | ||||||||

Bloomberg, as of November 30, 2024. The inception dates for respective funds: ZWH = February 10, 2014, ZWU = October 20, 2011, ZWK = February 12, 2019, ZJAN = January 24, 2024.

1 Bloomberg, as of November 30, 2024.

2 Price-to-Earnings (P/E) Ratio: A measure of a company’s share price relative to its earnings per share (EPS). Often called the price or earnings multiple, the P/E ratio helps assess the relative value of a company’s stock. Forward P/E is a version of the ratio that uses forecasted earnings to calculate the ratio. A lower forward P/E ratio may indicate that a stock is undervalued, while a higher forward P/E ratio may indicate that a stock is overvalued.

Disclaimer:

Changes in rates of exchange may also reduce the value of your investment.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

The portfolio holdings are subject to change without notice. They are not recommendations to buy or sell any particular security. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Buffer ETFs seeks to provide income and appreciation that match the return of a Reference Index up to a cap (before fees, expenses and taxes), while providing a buffer against the first 15% (before fees, expenses and taxes) of a decrease in the Reference Index over a period of approximately one year, starting from the first business day of the stated outcome period.

An investor that purchases Units of a Structured Outcome ETF other than at starting NAV on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

January 6, 2025