What are liquid alternatives?

First, a bit of background. What are alternative investments? The asset class is actually pretty wide ranging, and encompasses things like private equity, private debt (which are stocks and bonds issued by companies that are not listed on the public markets), real estate, infrastructure, commodities, and hedge funds.

They are sometimes integrated into portfolios to either help reduce volatility or correlation to broad bond or equity markets, or to help boost returns.

Until recently, many of these strategies were not readily available to most investors. They were accessible only to large institutional investors like pension funds, ultra high net worth individuals, or accredited investors.

In January of 2019, there was an amendment to the National Instrument 81-102, which is the law governing investment funds including mutual funds and exchange traded funds in Canada. This provision made it so that liquid alternative investment strategies would be accessible to all Canadians, not just hedge funds and high net worth investors.

What are liquid alternatives? Many new funds created in the aftermath of this regulatory amendment, now offer alternative investment strategies in a wrapper that allows for daily liquidity and 1 day settlement rather than monthly or quarterly redemption windows for traditional alternatives.

How have ETFs given investors access to hedge fund strategies?

Long short ETFs are an example of such a liquid alternative strategy. They democratize access to a short selling strategy, within an ETF, and are a game changer in the investment world:

- You have intraday liquidity (buy and sell anytime during market trading hours),

- full transparency (investors can see a full list of all the names in BMO’s ETFs, both long and short positions)

- BMO’s Long Short ETFs have no performance fees over and above the management fee (which is a common practice in other Long Short ETFs)

- no additional paperwork or additional licensing required.

What is a long/short equity strategy?

To set the stage, let’s first talk about what short selling is. Short selling is the sale of a security that the seller has borrowed. The short seller believes that the borrowed security’s price will decline, enabling it to be bought back at a lower price for a profit. The difference in price between what they sold it for and what they buy it back for, represents the short seller’s gain (or loss).

Traditionally, short selling was used by hedge funds and high net worth investors. Most mutual funds in Canada were not able to short sell for regulatory reasons. With the recent changes to regulations, MF’s and ETFs are now able to take advantage of short selling as long as it is specified in the fund’s prospectus, and subject to certain limits.

For an individual investor, in order to engage in short selling, your brokerage account must be pre-approved for margin trading, so you can borrow funds against the value of your margin eligible securities. Margin trading is an investment strategy catered towards more experienced investors and is considered a higher risk trading strategy.

In a long-short strategy, the portfolio manager goes long, or holds the stocks that according to their analysis have superior fundamentals and prospects, and they short sell the stocks with weaker fundamentals and outlook – so there is the opportunity to make money both on stocks in the portfolio going up, and on price declines in the short positions.

How does it work? BMO’s approach to ZLSU/ZLSC.

In our Long Short ETFs, BMO Long Short US Equity ETF (ZLSU) and BMO Long Short Canadian Equity ETF (ZLSC) we use a robust model-driven methodology to identify candidates both for the long and short names, in order to build well balanced and risk-controlled portfolios.

Our monthly rebalancing process takes into consideration new market information, reconstructing the optimal portfolio, while considering trading costs.

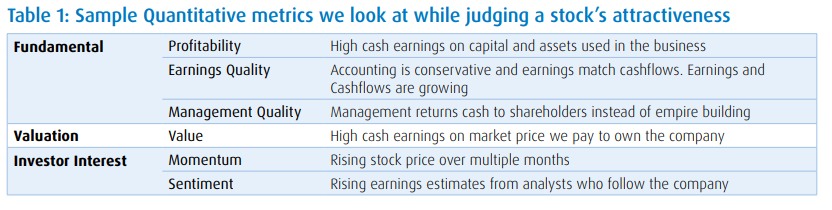

Stocks are compared relative to their sector peers based on fundamentals, and receive an alpha1 score based on their relative attractiveness. (See table below explaining what factors are taken into consideration when calculating a company’s alpha score).

Companies that score well across multiple metrics have historically outperformed, while companies that scored badly have historically underperformed.

The weighting of the sub-component factors is monitored and weighted towards the most strongly performing factors in the respective markets.

What are some of the myths associated with long/short strategies?

- Access

One misconception is that long short strategies are inaccessible to ordinary investors. Due to the change in regulation regarding liquid alternatives in Canada, and the subsequent proliferation of investment products, there is now much more choice.

Some of these products are available as mutual funds and ETFs, which do not have a high minimum initial investment, and there is no additional paperwork to fill out.

Traditional alternative investments were only available to institutional investors or to accredited investors with investable assets over $1 million, and required high minimum investment and were only offered via offering memorandum and required additional paperwork to be completed in order to purchase.

- Liquidity

Traditional alternative investments tend to have lower liquidity than investments in public markets (stocks, bonds, ETFs), and may only offer quarterly or monthly liquidity if an investor wishes to sell.

ZLSU and ZLSC trade on exchange and offer intraday liquidity – investors can buy or sell anytime during the trading day.

- Risk level

Another misconception is that alternative investments are riskier compared to traditional long-only public market investing.

The BMO Global Asset Management’s (GAM) long short equity strategies are rated low to medium risk2. They have demonstrated a lower level of risk compared to broad market indices and provide an exposure with a risk level that would be more in line with a fixed income or balanced portfolio. Visit our website to learn more on performance: www.bmoetfs.com. How can investors include a long/short ETF in a portfolio?

As an example, to illustrate how these can be used in investor portfolios, we will use a traditional balanced allocation of 60% equities and 40% fixed income as a starting point.

More conservative investors can allocate a portion (say, 10% of their total portfolio) of what they would normally put into fixed income, and allocate that 10% to the long short strategy (which would be classified as alternatives) in order to generate a higher level of returns.

More growth-oriented investors may consider allocating a portion of 10% or so of their equity holdings to the long-short strategy in order reduce the overall level of risk of their portfolio.

Three important considerations regarding long/short funds:

- Many long-short managers charge additional performance fees over and above the MER of the fund, which are typically more expensive than traditional investment strategies to begin with. Again, BMO GAM is breaking with tradition here, and is offering the long short ETFs at a competitive price point – the management fee is 0.65%, and we do not charge any additional performance fees.

- Transparency is another important consideration. Many long short funds are “black box” type strategies, where there is only very limited information available on the investment process and what the holdings are within the fund. The BMO GAM long short ETFs disclose the entirety of their holdings, both long and short, on a daily basis. In addition, we disclose a very thorough description of how we score companies in order to determine whether we want to own them outright or short sell them.

- Interpreting performance correctly – benchmark considerations. Comparing the returns of a long-short strategy to a traditional equity benchmark such as the S&P500 or S&P/TSX Capped Composite would be misguided.

Because the BMO long-short strategies have a beta3 of 0.5 (half the volatility versus the broad market indexes), performance should be measured accordingly. A benchmark of 50% S&P500 Index (C$) and 50% in Federal Reserve U.S. 3-M index (C$), is more appropriate for ZLSU. For ZLSC: 50% S&P/TSX Composite Index and 50% Government of Canada 3-M Treasury Index would be suitable for getting a true sense of how the strategy has performed.

| 1 Year Total Return | 50/50 Blend of S&P 500 index (C$) & U.S. Tbills Index (C$) Unhedged | Outperformance |

| +32.25% | +23.41 % | +8.84% |

*Note: performance is index returns, and gross of fees. You cannot invest directly in an index. S&P 500 Index (C$) and Federal Reserve U.S. 3-M Treasury Index (C$).

| ZLSC 1 Year Total Return | 50/50 Blend of S&P/TSX composite & Canadian T-Bill Index | Outperformance |

| +25.14% | +7.301% |

. Source: BMO GAM as of Nov 30th 2024. Performance is index returns, and gross of fees. You cannot invest directly in an index. For illustrative purposes only.

Many investors are on the hunt for a solution that can bring a differentiated return stream and diversification benefits to their portfolio. BMO’s Long-short ETFs are game-changers when it comes to liquid alternatives in Canada and can fit that need for investors. To learn more visit www.bmoetfs.com.

Performance Data (as of November 30, 2024):

| Fund | YTD | 1-Year | 2-Year | 3-Year | 5-Year | 10-Year |

Since Inception

|

Inception date | |||||

| BMO Long Short US Equity ETF (ZLSU) | 32.95% | 32.25% | 30.30% | Sep 27, 2023 | |||||||||

| BMO Long Short Canadian Equity ETF (ZLSC) | 23.05% | 25.14% | 24.02% | Sep 27, 2023 | |||||||||

| BMO S&P500 Index ETF (ZSP) | 34.98% |

|

25.52% | 14.50% |

|

15.23% | Nov 14, 2012 | ||||||

| BMO USD Cash Management ETF (ZUCM) | 10.68% | 8.58% | 8.55% | Sep 27, 2023 | |||||||||

| BMO S&P/TSX Capped Composite Index ETF (ZCN) | 25.64% | 30.55% | 15.53% | 10.83% | 11.89% | 8.94% | 8.62% | May 29, 2009 | |||||

| BMO Money Market ETF (ZMMK) | 4.46% | 4.92% | 4.90% | 3.79% | 3.79% | Nov 29, 2021 |

1 Alpha: A measure of performance often considered the active return on an investment. It gauges the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

2 The BMO long short equity strategies are rated low to medium risk. All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

3 Beta: A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. By definition, the market, such as the S&P 500 Index, has a beta of 1.0. A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock’s beta is less than 1.0.

Disclaimer:

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.