At a time when market volatility, rising rates and high inflation are a common denominator, investors are looking for alternative solutions that can boost returns, while diversifying their asset mix away from traditional assets and fixed income.

In 1991, an investor with a portfolio of only Canadian bonds could have earned an annualized return of ~11% over 5 years.1 Investors have increasingly had to look to alternative assets to add diversification, for growth and income generation, and enhanced returns with more challenging market environments.

Alternative investments include non-traditional assets, like real estate and infrastructure. Investors can access these types of investment through ETFs that invest in public securities to give exposure to alternative investments offering greater diversification to a portfolio.

Infrastructure:

When focusing on infrastructure as an alternative investment, it is important to first define what infrastructure actually is. One way to think of it is that infrastructure is the essential underpinning of modern industrial societies. All the core physical structures that allow us to function and enjoy modern life. Examples of such modern physical structures are transportation (roads, bridges, railroads etc.), energy infrastructure (energy transmission lines and pipelines), telecom infrastructure (cell phone towers) etc. – the things that allow all commerce to occur across the globe.

These core assets to modern life are staples for society and you don’t see demand vary much with the economic cycle. This lends to a few key attractive characteristics that makes infrastructure good to look at from an investment perspective.

So why Infrastructure?

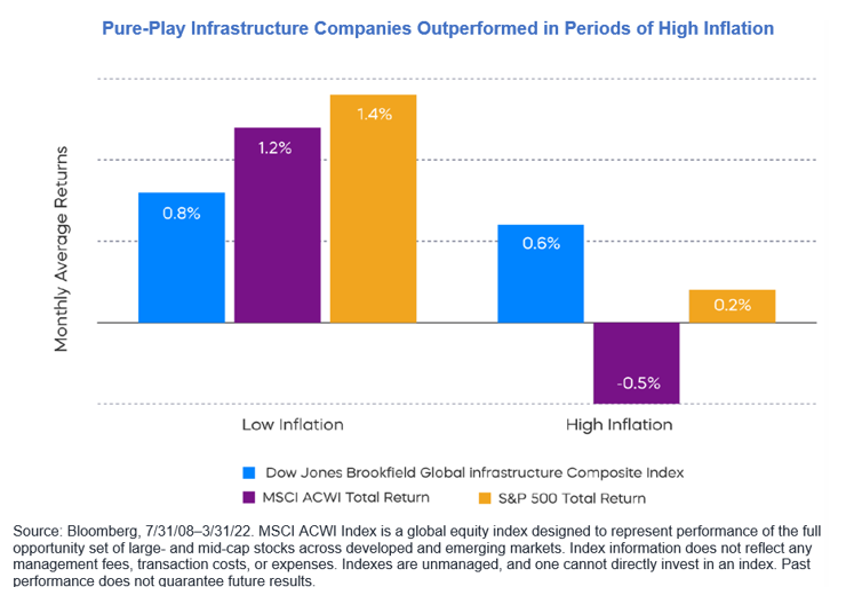

One of the aspects that makes Infrastructure a good hedge or offset to the cost of inflation is the nature of the underlying business. These businesses are often supported by long-term contracts with governments, municipalities, or cities. This could lead to relatively steady cash flow with a potential yield component. Another important aspect to consider is that the high barrier to entry in the marketplace which does not encourage competition to come-up easily (mostly monopolistic businesses).

In a lot of the cases, contracts are linked to inflation or the operators have the ability to pass on the inflation to the end consumers. Because of the nature of the services being provided, people aren’t going stop paying the costs associated with services and products. You can rely on income being generated. So essentially, there is baked in inflation protection.

Another factor to look at is the long-term drivers supporting growth in the space. Infrastructure has strong longer-term structural tailwinds that comes from both the developed (updating aged assets) and emerging markets (improving their infrastructure).

ETFs have made accessing the world of Infrastructure a lot simpler providing access to an asset class once reserved for institutional investors. To learn more about BMO ETFs’ Global Infrastructure Index ETF (ZGI) visit us by click this link.

Inflation Protection with Brookfield Public Securities: Global Real Estate Infrastructure & Renewable Infrastructure

Inflation has become an increasingly important theme, as interest rates are rising and inflation remains high. Advancements in technology have created increased demand for real estate technology infrastructure, specifically in industrial, communications infrastructure, and data centres. In addition, with the projected investments of ~$25 trillion in renewable generation capacity and ~$75 trillion in grid modernization and energy efficiency through 2050 renewable infrastructure may provide excellent growth potential.2 BMO has partnered with Brookfield Public Securities to offer two actively managed infrastructure ETFs focused on these two themes.

BMO Brookfield Global Real Estate Tech Fund (TOWR) combines the benefits of an ETF with the advantages of alternative investments. The ETF provides exposure to global publicly traded companies that are seeking to capitalize on the growth of demand for technology infrastructure, including data centers, communications infrastructure, and industrials.

BMO Brookfield Global Renewables Infrastructure Fund (GRNI) combines the benefits of an ETF fund with the advantages of alternative investments. The ETF provides exposure to global publicly traded companies that are seeking to capitalize on the multi-decade transition to renewable energy, including wind and solar, clean power, clean technology, water sustainability, and opportunistic transitioning companies.

1: Before fees and inflation, source: BMO ETFs

2: Source: Brookfield Public Securities Group LLC, International Renewable Energy Agency. As of December 31, 2021.

DISCLAIMER:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

This presentation is for informational purposes only. No part of this presentation may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, recording or otherwise, without the written permission of BMO Investments Inc. or BMO Asset Management Inc. (collectively, BMO GAM) ).

For greater certainty, no part of this presentation may be provided to investors and/or potential investors without the written permission of BMO GAM. The information contained herein is not, and should not be construed as, investment advice and or tax advice to any individual. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. This communication is intended for information purposes only. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. BMO GAM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. BMO ETFs and ETF Series trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.