Here’s a look at how structured outcome ETFs can help limit volatility and drawdowns for investors with a lower risk profile.

Do you remember learning to ride a bike? Chances are, you started with training wheels. As adults, we might scoff at them now, but back then, they were invaluable—keeping you from falling down as often or as hard. Sure, they limited your speed and agility, but the trade-off for extra safety was worth it.

It turns out you can use a similar concept in investing to help reduce volatility and limit losses. While some people lean on high-quality bonds or low-beta stocks, another approach involves derivatives.

Unlike strategies reliant on correlations1 holding steady, derivatives are grounded in math—designed to deliver structured outcomes regardless of broader market behavior.

If you’re a risk-conscious investor (and let’s be honest, in today’s uncertain markets, who isn’t?), buffer ETFs offer another way to protect your portfolio. Here’s how these specialized ETFs work and why they might be worth a look.

Why investors should care about risk

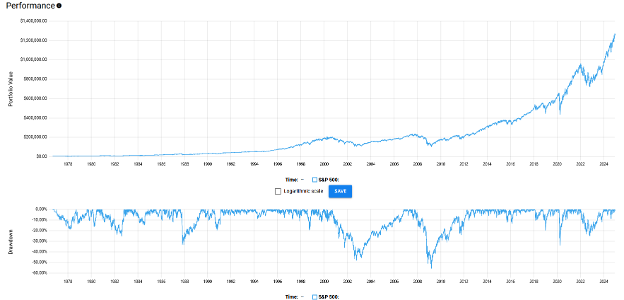

If you’d invested $10,000 in the S&P 500 from August 31, 1976, to December 11, 2024, the results on paper look spectacular: a 10.56% compound annual growth rate (CAGR)2 turning that initial sum into a staggering $1,271,197.033.

Source: testfolio.io as of December 13, 2024.

What’s the catch? It assumes one critical thing—that the hypothetical investor stayed the course, never panicked, and avoided trying to time the market. That’s far easier said than done, thanks to two significant sources of risk: volatility and drawdowns.

Volatility4, measured by standard deviation, reveals the typical ups and downs in the market. For this investment, the standard deviation sat at 17.54%. What does that mean? Historically, there has been instances where our hypothetical investor watched their portfolio swing dramatically in value, sometimes by tens of thousands of dollars in a single year. The more money you have, the more nerve-wracking these fluctuations can become.

Then there’s the maximum drawdown—the peak-to-trough drop during a crisis. In this case, the 2008 financial crisis saw our investor’s portfolio plummet 55.26%, shrinking from over $200,000 to just over $100,000 in a matter of months. Imagine watching half your portfolio evaporate, with no guarantee at the time it would ever recover.

Ask yourself this: even knowing in hindsight that things worked out, could you have stayed the course during such a catastrophic drawdown? If the answer is no, then perhaps limiting both the ups and downs of your investments might help you sleep better at night.

How buffer ETFs work

Buffer ETFs could therefore be a solution for reducing these emotional and financial roller coasters. To put it simply, these ETFs employ the financial equivalent of “training wheels” to limit the range of investment results over a time period – hence the name “structured outcome”.

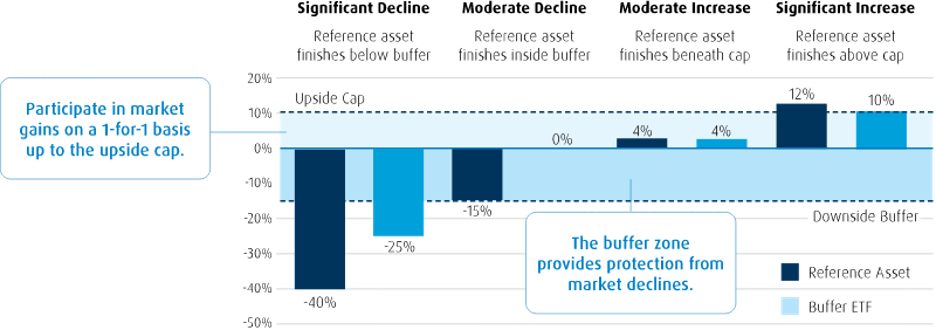

Buffer ETFs aim to protect against market declines while allowing for participation in the upside, up to a pre-determined limit. Of course, this protection comes with a trade-off: giving up some of the upside potential in exchange for reduced downside risk.

But this can be particularly useful given the asymmetric nature of returns and losses—for instance, a 10% loss requires an 11.1% gain to break even, a 25% loss requires a 33.3% gain, and a 50% loss needs a whopping 100% recovery just to get back to square one5.

A buffer ETF is pegged to the price return of a reference asset, such as the S&P 500 index, and employs an options overlay to create the buffer. For example, BMO’s buffer ETFs offer a 15% buffer, meaning the ETF absorbs the first 15% of losses in the reference asset during a set time period.

If the market falls by 12%, the ETF absorbs the entire loss, leaving the investor unscathed. However, if the market declines by 20%, the investor will still experience a 5% loss beyond the buffer.

This protection doesn’t come for free. The cap, or maximum return you can achieve with the ETF, offsets the cost of the buffer. Essentially, options are sold to fund the protection, which limits the investor’s participation in upside gains.

Source6: BMO Global Asset Management as of December 13, 2024.

Understanding the fine print

One important aspect to note is that buffer ETFs are tied to specific outcome periods which usually is one year. The start of the outcome period usually corresponds to a calendar month. For BMO’s buffer ETFs, these periods and their corresponding caps and buffers are as follows:

| ETF | Name | Cap | Buffer | Outcome Period |

| ZOCT | BMO US Equity Buffer Hedged to CAD ETF – October | 8.00% | 15% | October 1, 2024 to September 30, 2025 |

| ZJAN | BMO US Equity Buffer Hedged to CAD ETF – January | 8.10% | 15% | January 20, 2025 to January 5, 2026 |

| ZAPR | BMO US Equity Buffer Hedged to CAD ETF – April | 10.00% | 15% | April 1, 2024 to March 31, 2025 |

| ZJUL | BMO US Equity Buffer Hedged to CAD ETF – July | 8.95% | 15% | July 2, 2024 to June 30, 2025 |

Data as of February 11, 2025. Starting cap and buffer is before fees, expenses, and taxes7.

Why is this important? The indicated cap and buffer only apply if you buy the buffer ETF on the start date of the target outcome period and hold it until the end. If you purchase the ETF in between these dates, some of the cap and buffer may already have been exhausted, and can lead to significantly different results.

1 Correlation: A statistical measure of how two securities move in relation to one another. Positive correlation indicates similar movements, up or down together, while negative correlation indicates opposite movements (when one rises, the other falls).

2 Compound Annual Growth Rate (CAGR): The compound annual growth rate is the rate of return that an investment would need to have every year in order to grow from its beginning balance to its ending balance, over a given time interval.

3 https://testfol.io/?s=3bxtY2WUeXL

4 Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation. Standard Deviation is a measure of risk in terms of the volatility of returns. It represents the historical level of volatility in returns over set periods. A lower standard deviation means the returns have historically been less volatile and vice-versa. Historical volatility may not be indicative of future volatility.

5 The calculation is based on the formula for the percentage gain required to recover from a percentage loss: Recovery Gain (%) = [(1 / (1 – Loss %)) – 1] x 100. For example: 10% Loss: Recovery Gain (%) = [(1 / (1 – 0.10)) – 1] x 100 = 11.1%, 25% Loss: Recovery Gain (%) = [(1 / (1 – 0.25)) – 1] x 100 = 33.3%, 50% Loss: Recovery Gain (%) = [(1 / (1 – 0.50)) – 1] x 100 = 100%. https://www.tacitim.com/the-importance-of-small-numbers/

6 https://bmogam.com/ca-en/products/exchange-traded-funds/buffer-etfs

7 https://bmogam.com/ca-en/products/structured-outcomes

Performance Data (as of December 31, 2024):

| Fund | YTD | 1-Year |

Since Inception

|

Inception date |

| ZOCT – BMO US Equity Buffer Hedged to CAD ETF – October | 7.94% | 7.94% | 10.39% | Sep 27, 2023 |

| ZJAN – BMO US Equity Buffer Hedged to CAD ETF – January | Returns are not available as there is less than one year’s performance data. | Jan 24, 2024 | ||

|

ZAPR – BMO US Equity Buffer Hedged to CAD ETF – April

|

Returns are not available as there is less than one year’s performance data. | Mar 26, 2024 | ||

| ZJUL BMO US Equity Buffer Hedged to CAD ETF – July | Returns are not available as there is less than one year’s performance data. | Jun 27, 2024 | ||

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Buffer ETFs seeks to provide income and appreciation that match the return of a Reference Index up to a cap (before fees, expenses and taxes), while providing a buffer against the first 15% (before fees, expenses and taxes) of a decrease in the Reference Index over a period of approximately one year, starting from the first business day of the stated outcome period.

An investor that purchases Units of a Structured Outcome ETF other than on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period.

All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus