The U.S. stock market, particularly the S&P 500 index, isn’t as uniform as it might seem. While you may think of it as a homogenous entity, its far from reality.

The S&P 500 can be broken down into 11 Global Industry Classification System (GICS) sectors: information technology, health care, financials, consumer discretionary, communication services, industrials, consumer staples, energy, utilities, real estate, and materials.

Each sector groups together companies that operate in the same industry and offer similar products and services. Historically, different sectors have also shown varying levels of sensitivity to market and economic conditions.

Some are cyclical, meaning they typically do well during economic expansions but struggle in downturns. On the other hand, some sectors are considered defensive, as their revenues and earnings remain stable regardless of economic cycles.

One well-known investment strategy that takes advantage of these differences is sector rotation, where investors shift their money between sectors based on macroeconomic indicators like GDP growth, interest rates, and inflation.

Source: SPDR Americas Research. ++/– indicates the best/worst two performing sectors. +/- indicates the third best/worst performing sectors. The Energy sector did not make the top/bottom three sectors during any cycles, as it is less sensitive to U.S. economic cycles but more driven by global supply and demand of crude oil. For illustrative purposes only. 1

However, for risk-conscious investors, another approach involves overweighting defensive sectors—particularly health care, utilities, and consumer staples—to provide better downside protection and reduce portfolio volatility.

What makes a sector defensive?

A sector is considered defensive when its companies provide goods or services that consumers continue to purchase regardless of economic conditions.2

For example, when the economy weakens, a consumer might delay buying a new car or upgrading their phone. These are discretionary purchases—non-essential items that can be postponed until financial conditions improve.

In contrast, even during a recession, people still pay their water and gas bills and continue buying household essentials like groceries and personal care products.

The underlying economic principle at play here is elasticity. In economics, elasticity measures how much the quantity demanded of a product changes in response to price or income changes.

Goods with inelastic demand see little fluctuation in consumption, even when prices rise or consumer income declines. This makes sectors with inelastic demand more stable during market downturns.

- Utilities: Electricity, water, and gas are necessities that households and businesses must pay for, regardless of economic conditions.

- Consumer Staples: Essential items like food, personal care products, and household goods remain in demand even when discretionary spending drops.

- Health Care: Medical services, prescription drugs, and insurance are critical expenses that people prioritize, often regardless of cost.

How defensive are these sectors?

One way to quantify how defensive a sector has historically been by looking at its beta, a measure of volatility relative to the broader market3.

The market itself has a beta of 1.0, meaning any stock or sector with a beta below 1.0 tends to be less volatile and moves less than the overall market during upswings and downturns.

When analyzing long-running sector ETFs, the historical five-year betas confirm that health care, consumer staples, and utilities have lower volatility than the broader market.

The Health Care Select Sector SPDR Fund (XLV) has a beta of 0.644, The Consumer Staples Select Sector SPDR Fund (XLP) comes in even lower at 0.575, and The Utilities Select Sector SPDR Fund (XLU) has a beta of 0.746. This suggests that all three sectors historically experience smaller price swings compared to the S&P 500.

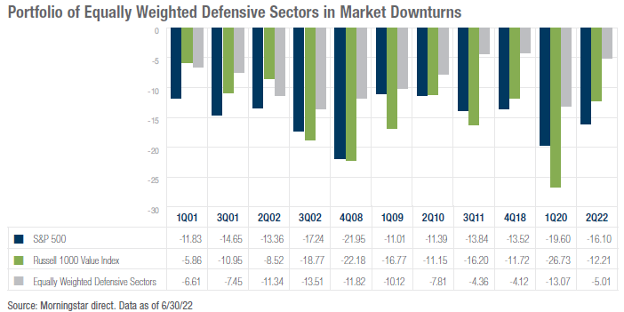

Further supporting this, research from State Street Global Advisors examined periods of steep market drawdowns. Between 1999 and 2022, there were 11 instances where the S&P 500 declined by 10% or more in a single quarter7.

They found that an equally weighted portfolio of health care, consumer staples, and utilities delivered significantly smaller losses than both the S&P 500 and the Russell 1000 Value Index.

Morningstar direct. Data as of 6/30/227

This demonstrates how overweighting defensive sectors has historically provided better downside protection in times of market stress versus broad market indices.

The ETFs for the job

BMO’s lineup of SPDR Select Sector Index ETFs includes three options that align with the defensive sectors discussed earlier. These ETFs provide targeted exposure to U.S. health care, consumer staples, and utilities, ensuring investors can overweight these segments without exposure to the rest of the S&P 500.

Each ETF tracks a corresponding sector-specific index by investing in the relative Select SPDR Fund, which isolates the respective stocks from the broader S&P 500. Since the S&P 500 already screens for large-cap companies with sufficient liquidity and earnings quality, these ETFs focus exclusively on well-established industry leaders within their sectors.

The three defensive sector ETFs are:

- BMO SPDR Health Care Select Sector Index ETF (ZXLV)

- BMO SPDR Consumer Staples Select Sector Index ETF (ZXLP)

- BMO SPDR Utilities Select Sector Index ETF (ZXLU)

All three trade in Canadian dollars and come with a competitive 0.20% management fee8. For investors looking to hedge against currency fluctuations, each also has a currency-hedged variant, denoted by the “.F” suffix9.

Sources

1 https://thehub.bmosalessupport.com/system/files/bmo_spdr_select_sector_index_etfs_brochure_en.pdf

2 https://corporatefinanceinstitute.com/resources/equities/defensive-industries/

3 https://www.investopedia.com/terms/b/beta.asp

4 https://finance.yahoo.com/quote/XLV/

5 https://finance.yahoo.com/quote/XLP/

6 https://finance.yahoo.com/quote/XLU/

8 https://bmogam.com/ca-en/products/exchange-traded-fund/bmo-spdr-health-care-select-sector-index-etf-series-etf-zxlv/, https://bmogam.com/ca-en/products/exchange-traded-fund/bmo-spdr-consumer-staples-select-sector-index-etf-series-etf-zxlp/, https://bmogam.com/ca-en/products/exchange-traded-fund/bmo-spdr-utilities-select-sector-index-etf-series-etf-zxlu/

9 https://bmogam.com/ca-en/products/exchange-traded-funds/sector-etfs

Disclaimers

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a “Select Sector SPDR ETF” or an “ETF” and collectively the “Select Sector SPDR ETFs” or the “ETFs”). Each Select Sector SPDR ETF is an “index fund” that invests in a particular sector or group of industries represented by a specified Select Sector Index. The companies included in each Select Sector Index are selected on the basis of general industry classification from a universe of companies defined by the S&P 500®. The investment objective of each ETF is to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in a particular sector or group of industries, as represented by a specified market sector index.

The S&P 500, SPDRs, and Select Sector SPDRs are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use. The stocks included in each Select Sector Index were selected by the compilation agent. Their composition and weighting can be expected to differ to that in any similar indexes that are published by S&P.

The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks.

The S&P 500 Index figures do not reflect any fees, expenses or taxes. An investor should consider investment objectives, risks, fees and expenses before investing.

You cannot invest directly in an index.

This article may contain links to other sites that BMO Global Asset Management does not own or operate. Any content from or links to a third-party website are not reviewed or endorsed by us. You use any external websites or third-party content at your own risk. Accordingly, we disclaim any responsibility for them.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.