The latest economic data unveils a captivating narrative of a strong and resilient economy in both Canada and the U.S. The current inflation stickiness and robust job market numbers make a solid case for the central banks in both countries to keep the interest rates higher for longer.

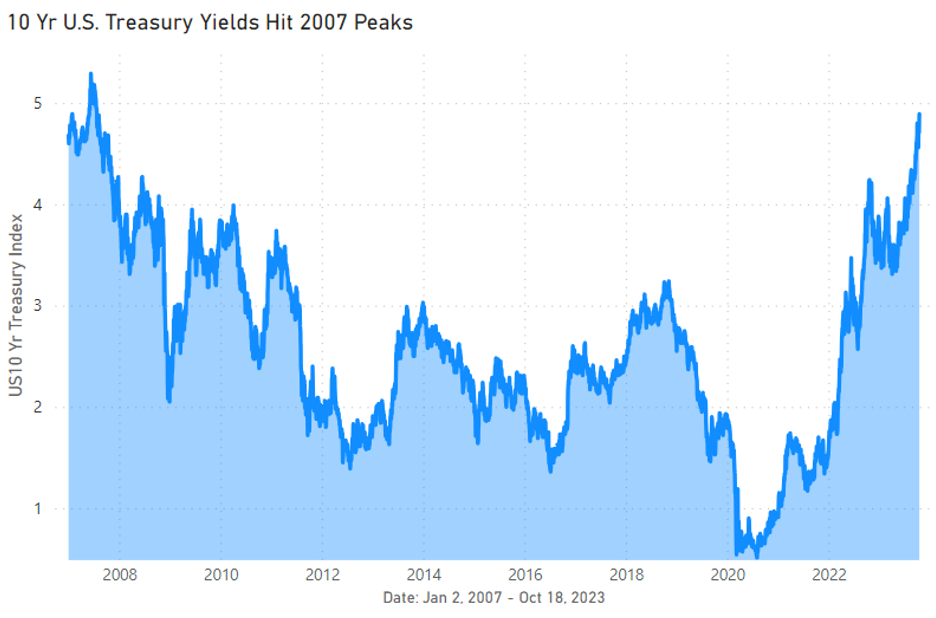

Towards the end of September 2023, markets basked in record high yields. However, earlier this month, based on the current situation in the Middle East, bond yields fell owing to an increase in demand for safer assets and caused longer-term bond prices to surge. The U.S. consumer prices remained elevated for the month of September and a pullback in demand for a treasury auction pushed the longer-term yields higher again resulting in the 10yr U.S Treasury yields touching their highest point since 2007. On the contrary, the recent CPI printed lower than expectations in Canada, yet the yields remain high as hot economic data continues to build pressure south of the border.

Source: Bloomberg

Source: Bloomberg

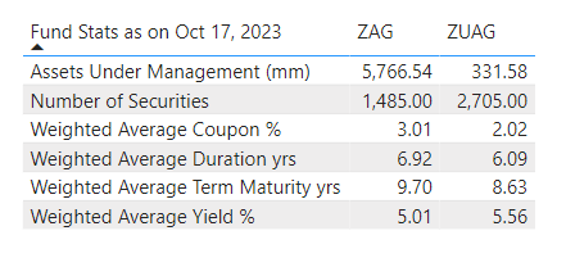

Given the current two-decade high interest rates, yields on Aggregate Bond ETFs have surpassed 5%, making them an interesting avenue for fixed income investors. Before we dive in further, let’s discuss some aggregate bond ETFs in detail along with their benefits.

Aggregate Bond ETFs as the Core of your Investment Strategy

Aggregate bond ETFs are exchange traded funds that aim to track performance of a diversified portfolio of bonds. These ETFs are referred to as core because it reflects their status as a foundational building block of a well-rounded investment portfolio. These ETFs can help investors achieve diversification, steady income & stability within their investment portfolios. BMO currently offers two Aggregate Bond ETFs:

- BMO Aggregate Bond Index ETF (ZAG) aims to replicate the performance of the FTSE Canada Universe Bond Index. This ETF primarily invests in a Canadian investment-grade fixed income securities consisting of Federal, Provincial and Corporate bonds, with a term to maturity greater than one year.

- BMO US Aggregate Bond Index ETF (ZUAG) tracks the performance of the Bloomberg US Aggregate Bond Index. It invests in the U.S. investment grade bonds such as U.S. treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, and asset backed securities with a term to maturity greater than one year. ZUAG is also offered as hedged to CAD (ZUAG.F) and in USD (ZUAG.U).

Source: BMO Asset Management.

These aggregate bond ETFs have proven to be an extremely viable investment solution owing to their key features:

- The Symphony of Diversification: Aggregate Bond ETFs provide exposure to a broad spectrum of bond market offering diversification across the curve, various sectors and segments, maturities, issuers, and credit qualities; making them resilient for any market environment.

For example, in the current high-interest rate environment, exposure to short duration bonds might provide some down-side protection. On the other hand, if central banks start cutting rates, then longer duration can provide some upside potential.

Aggregate Bond ETFs can also be considered an equity market hedge. Given the inverse correlation between equities and bonds, they can provide a cushion against market turbulence and can potentially outperform stocks during selloffs.

- Harnessing Cost Efficiency through Lower Fees: These ETFs are passively managed with the aim to track performance of the aforesaid indices. Their expense ratios are lower as compared to some actively managed funds, thereby reducing overall investment costs, and improving net returns for investors. BMO is currently charging a Management Expense Ratio of 0.09% for both ZAG & ZUAG.

- Liquidity & Ease of Trading: Like all other ETFs, ZAG & ZUAG are traded on stock exchanges, enabling investors to easily buy and sell shares throughout the trading day, allowing them to see real-time prices. The bid-ask spreads on these products are lower in contrast with the underlying bonds which enhances their liquidity compared to traditional bonds, making them a cost-effective way to attain the exposure to the aggregate bond market.

- Navigating Risk Management through High Credit Quality: Aggregate Bond ETFs are perceived as a stable and safer investment option as they provide exposure to investment-grade bonds, which are considered to have lower risk as opposed to high-yield or junk bonds. In the current rising interest rate environment, the credit quality & relative stability of the investment grade bonds make them an appealing choice for investors seeking to minimize risk & preserve capital.

Combined with the key features mentioned above, these Aggregate Bond ETFs provide investors with a low-cost core in any investment portfolio. They distribute monthly interest payments, providing a steady stream of income. These ETFs emphasize on preservation of capital and provide transparency and visibility into the funds’ composition and their underlying assets.

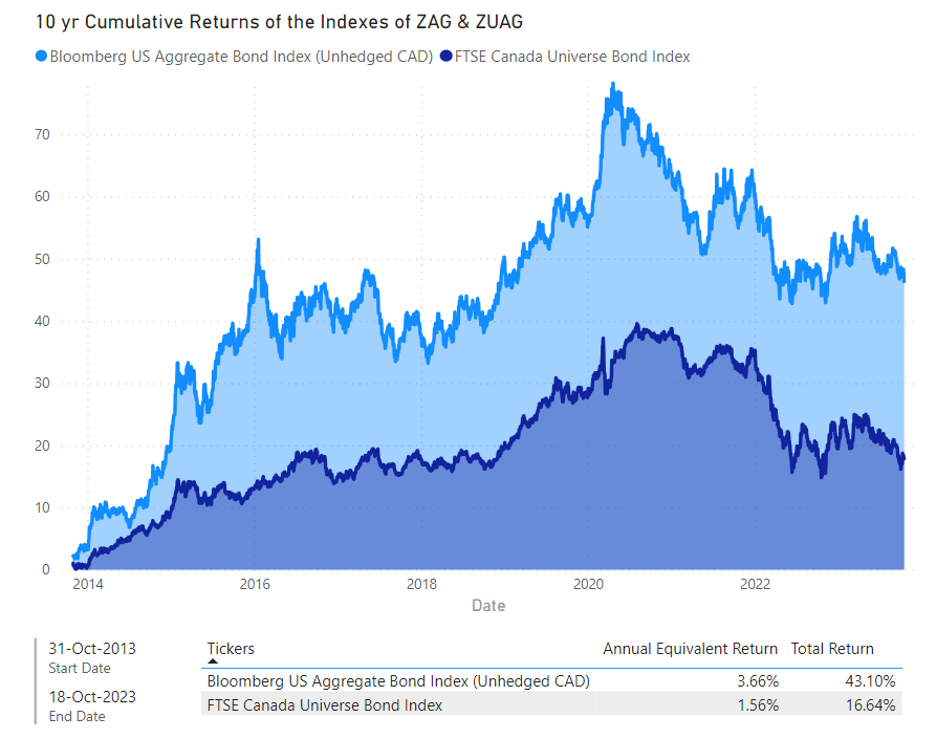

Visualizing a Decade of Growth – 10-year Comparative Performance

Although past performance is not indicative of future returns, looking at the 10-year performance of the benchmarks of these Aggregate Bond ETFs, one can deduce that these ETFs can serve as a well-diversified vehicle ideal for any economic environment. Considering their risk and return objectives, if investors opt to stay invested in these ETFs for long-term, they can weather short-term fluctuations and capitalize on the power of compounding.

Source: Bloomberg

Source: Bloomberg

Positioning for Prosperity: Devising a Strategic Portfolio Stance using Aggregate Bond ETFs as the Core

ZAG and ZUAG can be used as the core of investment portfolios to add diversification to equity exposures. They can be used as core fixed income investments and can be combined with other ETFs to complement their returns as market changes.

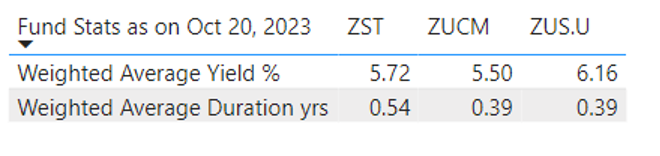

For instance, in the current high interest rate environment, combining these ETFs with an allocation to BMO USD Cash Management ETF (ZUCM), BMO Ultra Short-Term US Bond ETF (ZUS.U) or BMO Ultra Short-Term Bond ETF (ZST) a very attractive yield with limited duration and credit risk. If the goal is to get some inflation-protection, ZAG or ZUAG also can be combined with BMO Short-Term US TIPS Index ETF (ZTIP).

Source: BMO Asset Management.

If central banks decide to cut rates in 2024 or in case of a recession, exposure to longer-term federal bonds which are considered safe-haven assets can provide refuge from market volatility and uncertainty. So, combining ZAG or ZUAG with some allocation to BMO Long-Term US Treasury Bond Index ETF (ZTL) or BMO Long Federal Bond Index ETF (ZFL) may help stabilize the overall portfolio, over the long term.

Disclaimer:

Distributions are not guaranteed and may fluctuate. Distribution rates may change without notice (up or down) depending on market conditions. The payment of distributions should not be confused with an investment fund’s performance, rate of return or yield. If distributions paid by an investment fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by an investment fund, and income and dividends earned by an investment fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Please refer to the distribution policy for BMO ETF set out in the prospectus.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see Distribution Policy in the BMO ETFs’ prospectus.

This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

The views and opinions of the author in this communication do not necessarily state or reflect those of BMO Global Asset Management. This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Changes in rates of exchange may also reduce the value of your investment.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.