Portfolio Manager and Investment Strategist, Exchange Traded Funds

[email protected]

As we head into the year’s final quarter, investors are still trying to determine the state of the economy and the market over the next 12–24 months. While many have been vocal about where we find ourselves in the near future, nobody knows for certain, as many unknown variables can dictate the outcome.

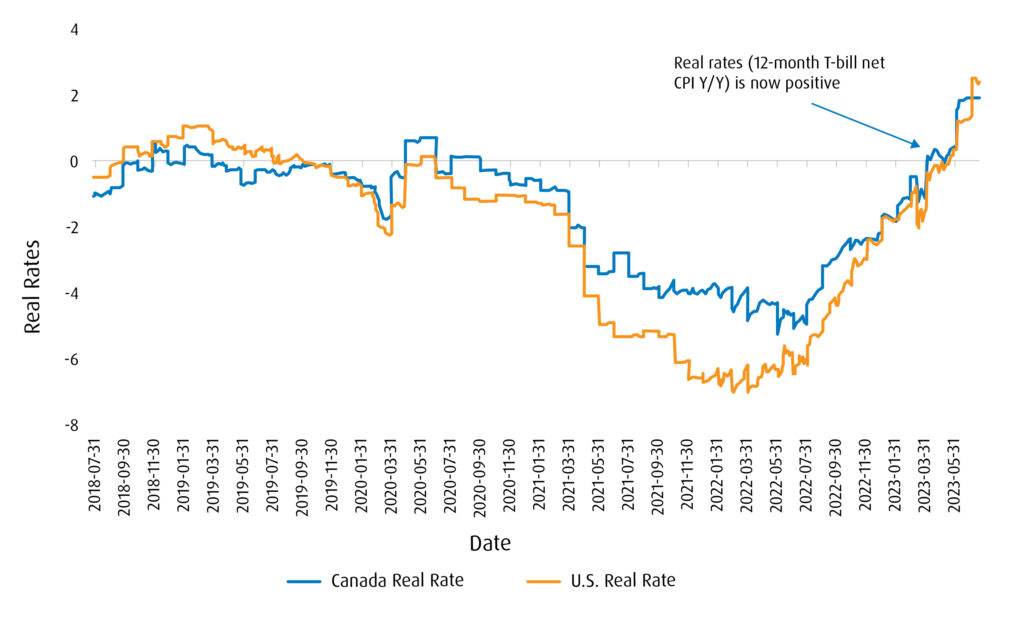

A year ago, we outlined that a reopening of the economy would initially cause inflation to rise until supply chains normalized, and then it would recede. Regardless of the data point, inflation has improved dramatically over the last 12 months. The disinflationary pressures have enabled central bankers to become less hawkish, allowing risk assets to recover in 2023.

Consumer price index (CPI) in the U.S. vs. Canada

Will we see a “soft,” “hard,” or “no landing” scenario?

Despite inflation looking remarkably better in 2023, we believe that outside of a geo-political or unforeseen black-swan event, inflation remains the primary risk factor that determines whether we find ourselves in a “soft,” “hard,” or “no landing” scenario. This is true as inflation will dictate the response of central bankers, and monetary policy still sets the tone for the markets despite a slight increase in the focus on microeconomics (particularly balance sheet durability) in the recent year. Unrest in the Middle East also has the potential to disrupt the oil supply, which can re-accelerate inflation.

Below, we outline how these three specific scenarios can transpire:

“Soft landing” (slight recession)

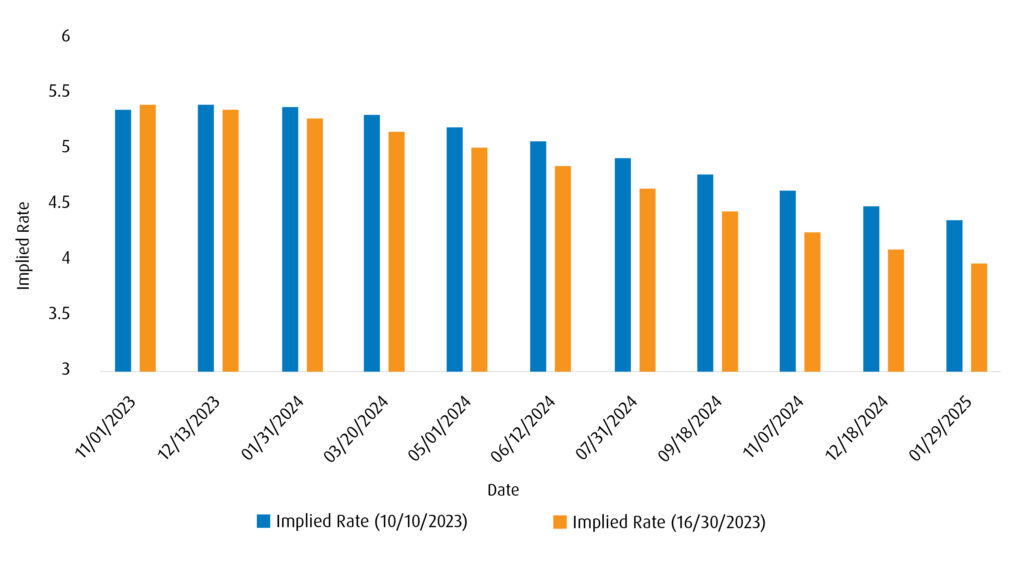

A “soft landing” remains our base case scenario. Although the recent CPI prints in Canada and the U.S. have been concerning, disinflation never occurs in a straight line and the base effect is partly the cause. Interest rate changes typically need 18–24 months to take full effect, so central bankers hope the slack of monetary tightening is working its way through the economy. If the worst of inflation is behind us, this allows central bankers to rely more heavily on forward guidance to rein in inflation. However, for forward guidance to be effective, occasional rate hikes may be used to give the Federal Reserve (Fed) and the Bank of Canada (BoC) credibility.

Central banks will then wait for the delayed effects of higher interest rates, which reinforces the higher for longer narrative. This would lead to a continuation of bond yields repricing higher, which means a further bear steepening in the yield curve. Interest rate cuts priced into the market would be pushed out further, favouring companies with durable balance sheets and those that are not overly leveraged.

Implied Inflation Trends Downward in Late 2024

Source: Bloomberg, Global Asset Management.

Source: Bloomberg, Global Asset Management, as of October 10, 2023.

“Hard landing” (deep recession)

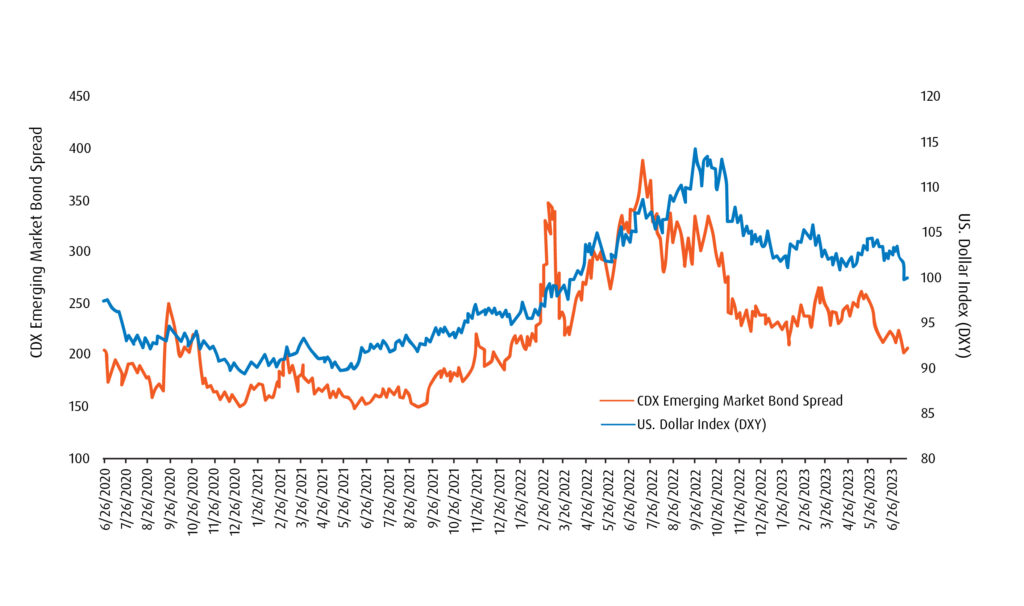

While inflation has trended in the right direction over the last year, the more recent CPI prints have been concerning, as there were signs of a reacceleration in prices. In Canada, the shelter component has risen, which is not surprising given mortgage payments are a function of interest rates and mortgage payments help determine the cost of rent. However, energy prices have been the primary concern, as oil prices have steadily risen since June. We view energy as one of the main wildcards in a scenario where inflation could re-accelerate. Increasing geo-political tensions could add to further supply chain disruption and exacerbate inflation. Price increases in this scenario would lead central bankers to tighten monetary policy aggressively, similar to 2022, which would lead to a hard landing. Recent coordinated attacks on Israel by Hamas could create instability in the region and, if further escalated, could disrupt oil supplies. Though there are no talks of an oil embargo, new information continues to surface daily, which needs to be digested.

Interest rates moving up too quickly would create a shock in the system, as we found a year ago with the implosion of U.K. pension plans and the U.S. regional bank failures earlier this year. This scenario would leave the Fed with the difficult choice of fighting inflation by hiking rates aggressively or giving up on the inflation fight and avoiding real economic hardship. This is the decision Fed Chairman Paul Volcker faced when inflation re-emerged in the early 1980s.

Focus on cash and “cash-like” investments, real assets and alternative strategies, such as long-short equities.

“No landing” (avoid a recession)

This scenario would be very similar to a “soft landing.” However, signs of normalizing inflation would come earlier and be more reaffirming. This would pave the way for central bankers to confidently ease interest rates as needed. The continued strength of the labour market makes this an outside possibility.

The yield curve would then normalize through a “bull steepener,” where short- and mid-term rates would fall more than longer-term rates. However, even in this scenario, we would not envision a rapid cutting of the overnight rate, as central banks would leave monetary easing in the holster for the next economic slowdown.

Focus on cyclical-oriented equities (Consumer Discretionary, Value) and lower quality fixed income (high yield).

While our assessment over the last year on disinflationary pressures has been accurate, recent geo-political tensions have increased uncertainty with oil, which is a wildcard in reigniting inflation. Our base case remains a soft-landing scenario; however, there are many variables and outside events that are rapidly unfolding, which could lead to a change and repricing of assets.

Energy is the real wildcard that can re-accelerate inflation, as it is an input cost on many goods, including transportation. The emptying of the U.S. Strategic Petroleum Reserve (SPR) over the last several years means it will need to be replenished eventually, placing an additional demand on the grid. There are many ways in which the Israel-Hamas conflict can unfold in the coming weeks and months, which could have a major impact on oil.

Recommendation: Energy has been one of our key growth themes, and unfortunately, the recent conflict could further exacerbate supply constraints on oil. A cold winter in Europe could lead Russia to weaponize natural gas supplies. All of this could put an increasing reliance on North American energy. North American energy companies have been steadily raising their dividends as they have been hesitant in expanding infrastructure, given the government’s push towards renewable energy reliance. The BMO Equal Weight Oil & Gas Index ETF (Ticker: ZEO)or theBMO Covered Call Energy ETF (Ticker: ZWEN)allow investors to target energy companies.

Underlying Constituents of BMO Equal Weight Oil & Gas Index ETF (Ticker: ZEO)

| Name | Ticker | % change in cash flow from operations | Cash flow from operating activities (now) | Cash flow from operating activities (1-year ago) |

| Arc Resources Ltd | ARX | 247.3% | 3,833.30 | 1,103.60 |

| Imperial Oil Ltd | IMO | 239.3% | 10,482.00 | 3,089.00 |

| Tourmaline Oil Corp | TOU | 321.9% | 4,692.73 | 1,112.20 |

| Keyera Corp | KEY | 584.9% | 925.33 | 135.10 |

| Cenovus Energy Inc | CVE | 178.9% | 11,403.00 | 4,089.00 |

| Enbridge Inc | ENB | 423.8% | 11,230.00 | 2,144.00 |

| Pembina Pipeline Corp | PPL | 281.9% | 2,929.00 | 767.00 |

| Canadian Natural Resources | CNQ | 218.0% | 19,391.00 | 6,098.00 |

| Suncor Energy Inc | SU | 252.4% | 15,680.00 | 4,449.00 |

| TC Energy Corp | TRP | 274.8% | 6,375.00 | 1,701.00 |

Source: Bloomberg (Cash Flow from Operations quoted in Millions).

*Cash from Operating Activities calculated as Net Income + Depreciation & Amortization + Other Noncash Adjustments + Changes in Non-cash Working Capital.

Coming into the year, we were optimistic that we would see a rebound in asset prices. Besides supply-side healing, there was already an extreme amount of negativity priced into the market. We anticipated that monetary policy would become less hawkish, particularly in North America, benefiting equities and bonds. Repricing in the broader markets has already occurred, which means the low-hanging fruit of simply buying “broad beta” for short-term returns is likely behind us for the time being. The Citi Economic Surprise Index supports this, showing recent positive data has been priced into the markets.

Recommendation: We believe tactical opportunities are still available in sector and thematic-based ETFs. Our three major themes include not only Energy but also large-cap U.S. Technology. We believe these two themes will provide growth to a portfolio. The other theme is Canadian banks, a trade based on attractive fundamental valuations. The BMO Covered Call Technology ETF (Ticker: ZWT) provides exposure to large-cap U.S. Technology companies with the addition of a covered call overlay. For Canadian bank exposure, investors can consider the BMO Equal Weight Banks Index ETF (Ticker: ZEB).

Over the last several months, the yield curve has been experiencing some normalization vis-à-vis a bear steepener. The U.S. five- and 10-year yields stand at 4.61% and 4.65%,1 respectively — the highest levels since 2007. This bond repricing results from the market finally acknowledging that interest rates will remain higher for longer. In the absence of a black swan event, we don’t expect the Fed or BoC to cut rates until later in 2024, which means the front end of the curve will remain relatively locked at 5.5% and 5.0%, respectively. For the yield curve in the U.S. and Canada to normalize, it probably means five- and 10-year yields would have to move higher.

Recommendation: Our recommendation for fixed income favours a barbell with an overweight to the short end of the curve. No matter how the yield curve eventually normalizes, the short end of the curve will likely be better positioned. We favour U.S. investment grade on the short end of the curve, given its greater diversification to Canadian corporates. Investors get some additional yield pick-up. The BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF (Ticker: ZSU) allows investors to target this area with a yield to maturity (YTM) of 6.0% and a duration of 2.55 years.1

Changes to portfolio strategy

| Sell/Trim | Ticker | (%) | Buy/Add | Ticker | (%) |

| BMO Ultra Short-Term Bond ETF | ZST | 2.0% | BMO Money Market Fund ETF Series | ZMMK | 3.0% |

| BMO Canadian Bank Income Index ETF | ZBI | 1.0% |

Asset allocation:

Equities:

Fixed Income:

Non-traditional/hybrids:

The strategy involves tactically allocating to multiple asset-classes and geographies to achieve long-term capital appreciation and total return by investing primarily in ETFs.

| Ticker | ETF Name | Sector | Positioning | Price | Management Fee* | Weight (%) | 90-Day Vol | Volatility Contribution | Yield(%) | Yield/Vol** |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed Income | ||||||||||

| ZDB | BMO Discount Bond Index ETF | Fixed Income | Core | $13.87 | 0.09% | 9.0% | 7.6 | 7.1% | 2.6% | 0.34 |

| ZSU | BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF | Fixed Income | Tactical | $12.85 | 0.25% | 7.0% | 4.1 | 3.0% | 3.3% | 0.81 |

| ZTIP.F | BMO Short-Term US TIPS Index ETF (Hedged Units) | Fixed Income | Tactical | $28.10 | 0.15% | 5.0% | 2.5 | 1.3% | 4.0% | 1.60 |

| ZTL | BMO Long-Term US Treasury Bond Index ETF | Fixed Income | Tactical | $35.33 | 0.20% | 5.0% | 6.8 | 3.5% | 3.9% | 0.57 |

| ZMMK | BMO Money Market Fund ETF Series | Fixed Income | Tactical | $49.96 | 0.12% | 3.0% | 1.3 | 0.4% | 4.9% | 3.64 |

| Total Fixed Income | 29.0% | 15.3% | ||||||||

| Equities | ||||||||||

| ZLB | BMO Low Volatility Canadian Equity ETF | Equity | Core | $39.39 | 0.35% | 17.0% | 10.8 | 19.1% | 2.9% | 0.27 |

| ZRE | BMO Equal Weight REITs Index ETF | Equity | Tactical | $19.45 | 0.05% | 4.0% | 16.5 | 6.9% | 5.5% | 0.33 |

| ZLU | BMO Low Volatility US Equity ETF | Equity | Core | $44.64 | 0.30% | 8.0% | 9.4 | 7.8% | 2.4% | 0.26 |

| ZLD | BMO Low Volatility International Equity Hedged to CAD ETF | Equity | Core | $24.48 | 0.40% | 7.0% | 9.5 | 6.9% | 2.8% | 0.29 |

| ZEO | BMO Equal Weight Oil & Gas Index ETF | Equity | Tactical | $64.51 | 0.55% | 4.0% | 17.5 | 7.3% | 4.6% | 0.26 |

| ZUH | BMO Equal Weight US Health Care Hedged to CAD Index ETF | Equity | Tactical | $65.17 | 0.35% | 4.0% | 10.6 | 4.4% | 0.5% | 0.05 |

| ZEB | BMO Equal Weight Banks Index ETF | Equity | Tactical | $31.33 | 0.55% | 8.0% | 13.9 | 11.5% | 5.3% | 0.38 |

| ZUQ | BMO MSCI USA High Quality Index ETF | Equity | Core | $62.89 | 0.30% | 10.0% | 11.9 | 12.4% | 1.0% | 0.08 |

| ZWT | BMO Covered Call Technology ETF | Equity | Tactical | $33.66 | 0.65% | 3.0% | 17.1 | 5.3% | 4.4% | 0.26 |

| Total Equity | 65.0% | 81.6% | ||||||||

| Non-Traditional Hybrids | ||||||||||

| ZPR | BMO Laddered Preferred Share Index ETF | Hybrid | Tactical | $8.84 | 0.45% | 3.0% | 7.1 | 2.2% | 6.3% | 0.89 |

| ZBI | BMO Canadian Bank Income Index ETF | Hybrid | Tactical | $26.93 | 0.25% | 3.0% | 2.6 | 0.8% | 3.4% | 1.31 |

| Total Alternatives | 6.0% | 3.0% | ||||||||

| Total Cash | 0.0% | 0.0 | 0.0% | 0.0% | ||||||

| Portfolio | 0.31% | 100.0% | 9.6% | 100.0% | 3.3% | 0.34 |

Source: Bloomberg, BMO Asset Management Inc., as of September 30, 2023. *Management Fee as of July 17, 2023. ** Yield calculations for bonds are based on yield to maturity, including coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity and. For equities, it is based on the most recent annualized income received divided by the market value of the investments. Please note yields of equities will change from month to month based on market conditions. The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

| Ticker | Name | Weight |

|---|---|---|

| ZLB | BMO LOW VOLATILITY CANADIAN EQUITY ETF | 17.0% |

| ZUQ | BMO MSCI USA HIGH QUALITY INDEX ETF | 10.0% |

| ZDB | BMO DISCOUNT BOND INDEX ETF | 9.0% |

| ZLU | BMO LOW VOLATILITY US EQUITY ETF | 8.0% |

| ZEB | BMO EQUAL WEIGHT BANKS INDEX ETF | 8.0% |

| ZSU | BMO SHORT-TERM US IG CORPORATE BOND HEDGED TO CAD INDEX ETF | 7.0% |

| ZLD | BMO LOW VOLATILITY INTERNATIONAL EQUITY HEDGED TO CAD ETF | 7.0% |

| ZTIP.F | BMO SHORT-TERM US TIPS INDEX ETF (HEDGED UNITS) | 5.0% |

| ZTL | BMO LONG-TERM US TREASURY BOND INDEX ETF | 5.0% |

| ZRE | BMO EQUAL WEIGHT REITS INDEX ETF | 4.0% |

| ZEO | BMO EQUAL WEIGHT OIL & GAS INDEX ETF | 4.0% |

| ZUH | BMO EQUAL WEIGHT US HEALTH CARE HEDGED TO CAD INDEX ETF | 4.0% |

| ZMMK | BMO MONEY MARKET FUND ETF SERIES | 3.0% |

| ZWT | BMO COVERED CALL TECHNOLOGY ETF | 3.0% |

| ZPR | BMO LADDERED PREFERRED SHARE INDEX ETF | 3.0% |

| ZBI | BMO CANADIAN BANK INCOME INDEX ETF | 3.0% |

| Total | 100.0% |

| Federal | 48.4% | Weighted Average Term | 12.01 |

| Provincial | 14.2% | Weighted Average Duration | 6.68 |

| Investment Grade Corporate | 37.4% | Weighted Average Coupon | 2.21% |

| Non-Investment Grade Corporate | 0.0% | Weighted Average Current Yield | 2.26% |

| Weighted Average Yield to Maturity | 3.78% |

Weighted Average Term: The average interest received by a bond investor, expressed on a nominal annual basis.

Weighted Average Current Yield: The market value-weighted average coupon divided by the weighted average market price of bonds.

Weighted Average Yield to Maturity: The market value-weighted average yield to maturity includes coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

Weighted Average Duration: The market value-weighted average duration of underlying bonds divided by the weighted average market price of the underlying bonds. Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates.

Weighted Average Coupon: The average time it takes for bonds to mature in a fixed income portfolio.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Source: Bloomberg, BMO Global Asset Management, as of October 10, 2023.

Visit bmo.com/etfs or contact Client Services at 1−800−361−1392.

To listen to our Views From the Desk BMO ETF Podcasts, please visit bmoetfs.ca.

BMO ETF Podcasts are also available on

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

Yield curve: A line that plots the interest rates of bonds having equal credit quality but differing maturity dates. A normal or steep yield curve indicates that long-term interest rates are higher than short-term interest rates. A flat yield curve indicates that short-term rates are in line with long-term rates, whereas an inverted yield curve indicates that short-term rates are higher than long-term rates.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the individuals represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The ETFs referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

This podcast presentation is for informational purposes only. No part of this presentation may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, recording or otherwise, without the written permission of BMO Investments Inc. or BMO Asset Management Inc. (collectively, BMO GAM) ).

For greater certainty, no part of this presentation may be provided to investors and/or potential investors without the written permission of BMO GAM. The information contained herein is not, and should not be construed as, investment advice and or tax advice to any individual. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. This communication is intended for information purposes only. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. BMO GAM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. BMO ETFs and ETF Series trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.

Copyright © 2022 Prosper Experiential Media. All rights reserved. | Privacy Policy | Terms & Conditions