Portfolio Manager and Investment Strategist, Exchange Traded Funds

[email protected]

In this report:

After taking a pause in its tightening cycle, the Bank of Canada (BoC) raised rates by a quarter-point for a second consecutive meeting as of July. The U.S. Federal Reserve (Fed), which also paused for a meeting, is expected to increase its overnight lending rate in the coming months. However, we don’t see this step backward as a sign the central banks are moving toward aggressive tightening measures. Instead, we believe they are shifting to a data-dependent policy, thus, being more reactive.

Inflation trending in the right direction

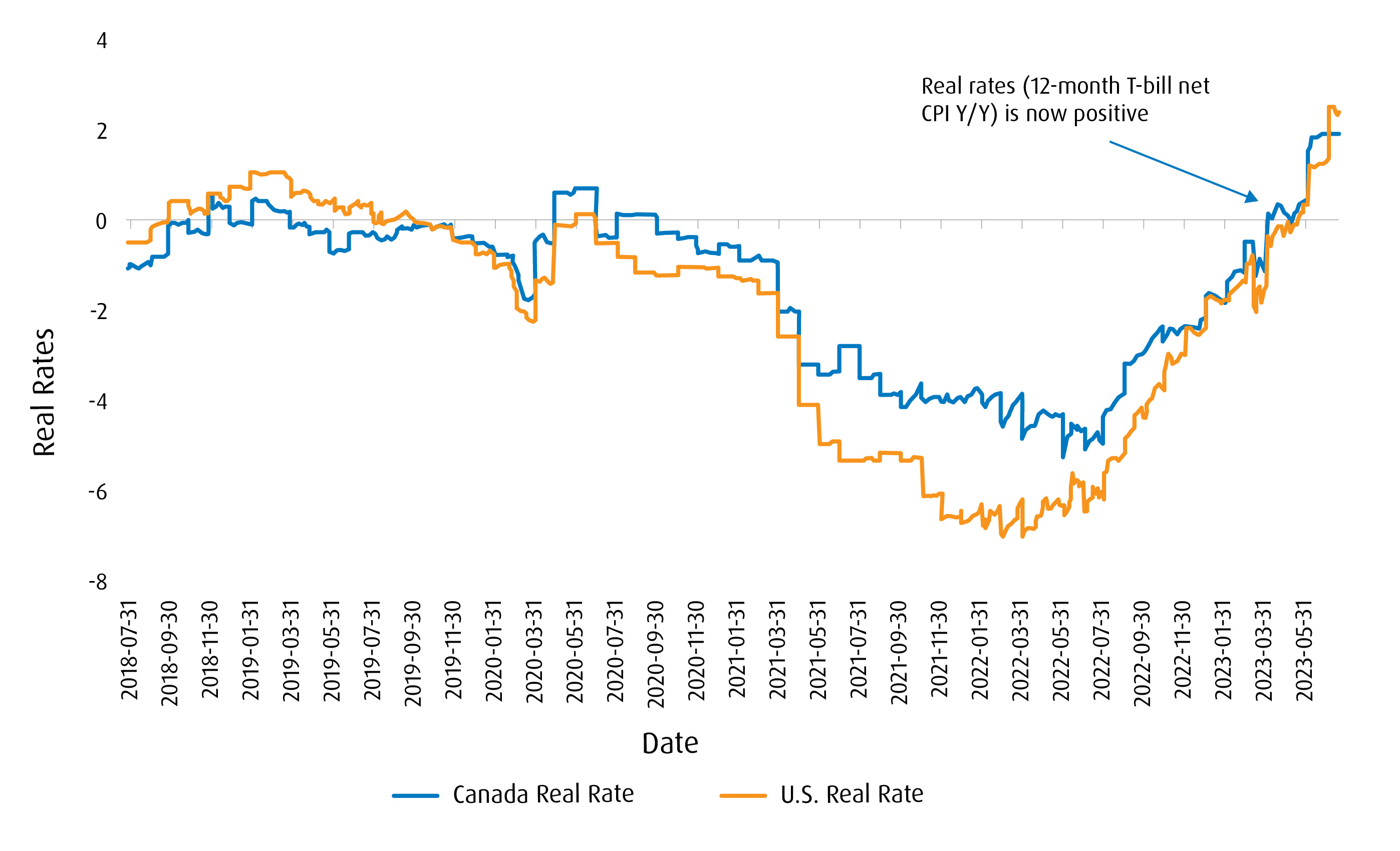

Since the economic reopening, our thesis has been that inflation would be high initially, as demand would outstrip supply and, eventually, we would see disinflationary pressures when supply chains caught up. This looks to be the case now, as data suggests inflation is on the mend. We believe the shift in policy is appropriate — particularly as it takes an average of 18–24 months for higher rates to work their way through the economy. The occasional hike allows the central banks to maintain credibility to implement forward guidance, which could be a tool the Fed and BoC increasingly lean on. Some have argued that a cooling Consumer Price Index (CPI) in Canada and the U.S. has been driven lower by the base effect and higher energy prices a year ago; however, other data suggests inflation is on the mend. Real rates, which we monitor as the difference between the 12-month T-bill and CPI (year over year), have become positive in the last quarter in both countries.

Pressures mount on discretionary spending

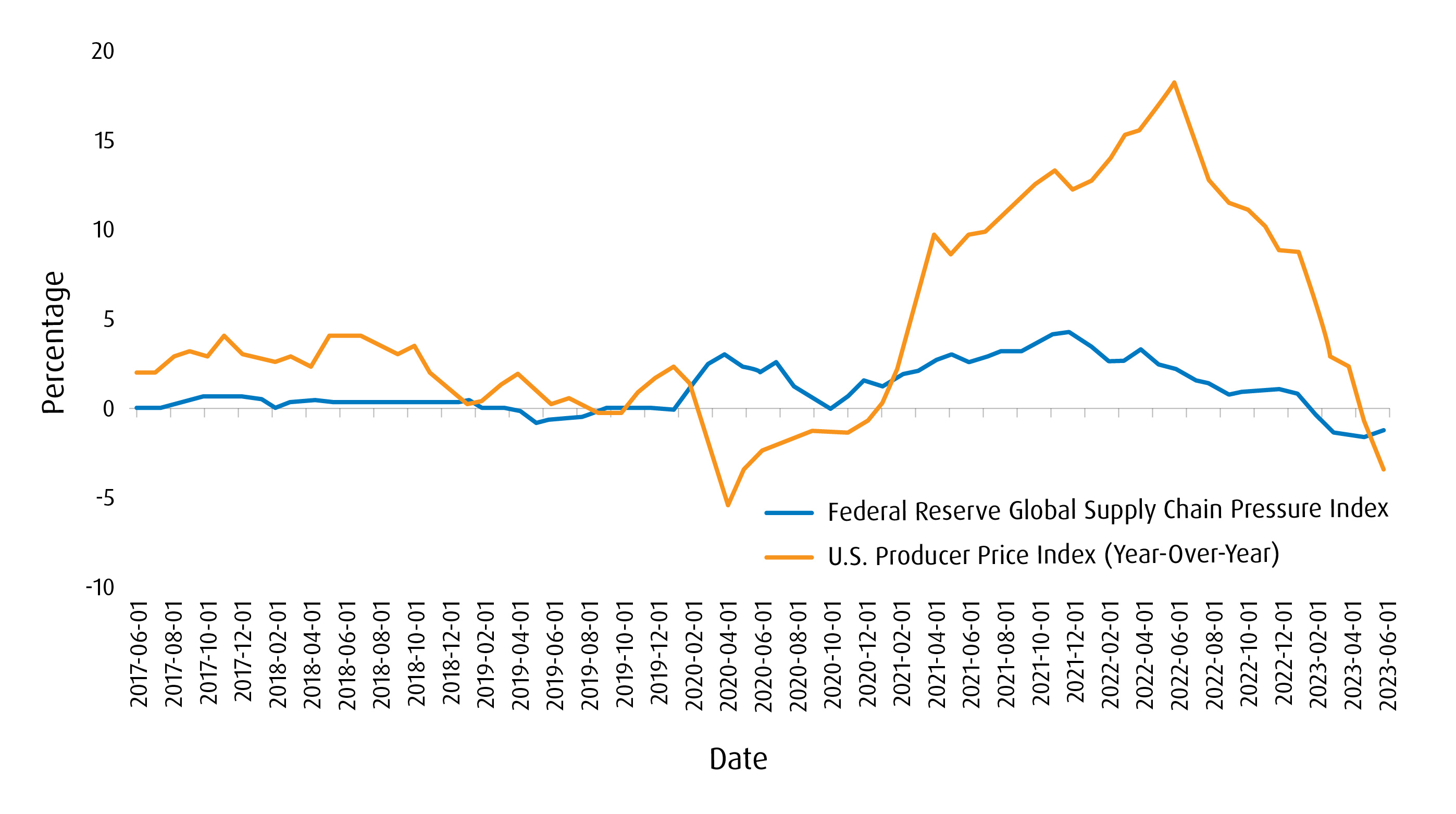

While inflation on services has been more resilient than that of goods, we anticipated this, assuming the lockdowns of years past would lead to demand for travelling and hospitality. The recent U.S. CPI numbers showed hotel and airfare demand to be down. As household debt remains at record levels in Canada, we expect the BoC to have more leverage in its rate hikes, as it places further stress on wallets and discretionary items, such as vacations and restaurants, which will be the easiest to eliminate. On the goods front, leading indicators, such as the Fed’s Global Supply Chain Pressure Index, have more than normalized. As projected in previous quarterly reports, supply in many areas would eventually catch up with demand, leading to disinflation.

The buzz around AI mega-cap Tech stocks

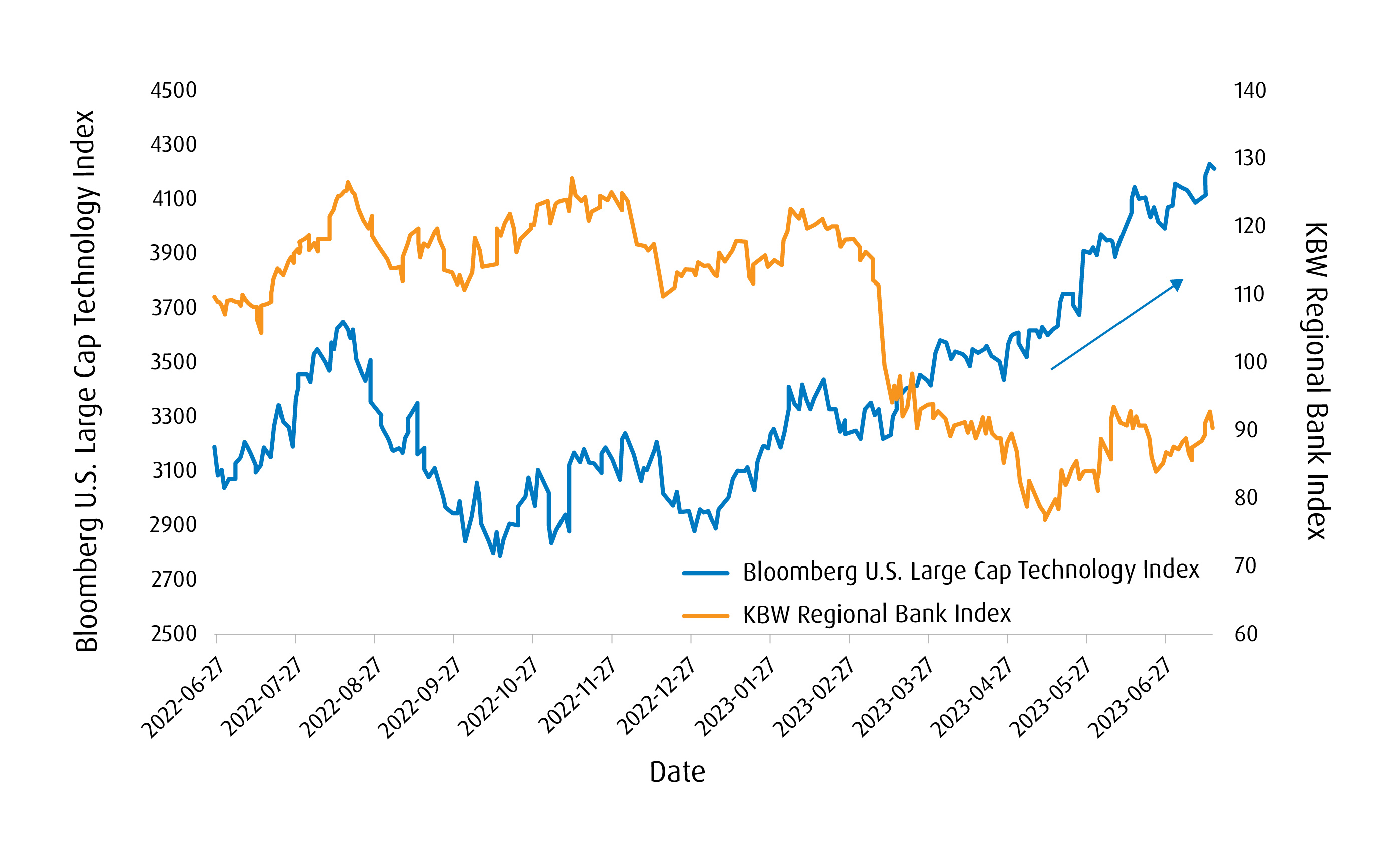

The Fed nearing its terminal rate could not come at a better time, as further hikes would add more pressure on the regional banks and their held-to-maturity portfolios. The easing of monetary tightening also provides a more favourable environment for long-duration stocks like Technology. Since the bankruptcy of Silicon Valley Bank in March, the KBW Regional Bank Index has become negatively correlated with the U.S. Technology sector. In addition, the “buzz” around Artificial Intelligence (AI) will likely provide tailwinds for larger-cap Technology names.

Our view on risk assets

While we remain constructive on risk assets, we are cautious given the ongoing risks. Geo-political threats in the Russia-Ukraine conflict and tensions between China and Taiwan can escalate. As we draw closer to the end of the year, the noise will probably grow between the Republicans and Democrats as the U.S. prepares for a presidential election year. The inverted yield curve should also be watched, and we will look closely at it throughout the report. However, we are still constructive on equities going into the second half, though we believe the pace of gains will moderate. With sustained higher interest rates, a focus on higher quality companies with durable balance sheets should be the focus for equities and fixed income. We also anticipate low volatility to play a role in providing stability in the back half of the year.

There’s been much focus on the yield curve, given its inversion has been the steepest we’ve seen in decades — and, historically, an inverted yield curve has been one of the most reliable indicators of an impending recession. While recessions rarely bide well for risk assets, investors should note that market dynamics in the last two years have been different, as inflation has been the primary focus. When demand significantly exceeds supply, central banks’ response has been to slam on the proverbial brakes rather than the accelerator via monetary policy. As a result, an inversion of the yield curve suggests that central bankers have successfully engineered a slowdown to equalize demand and supply. If you view the yield curve as the term structure of interest rates, an inversion would suggest the market believes inflation will be controlled. This would be like the yield curve inversion coming off of the inflationary period of the 1980s.

Recommendation: While we would not want to bet against a yield curve, we believe some positives can be taken from its inversion. A normalized yield curve would suggest central bankers have more tightening ahead. We’ve been highlighting the benefits of a bond barbell, which utilizes short-term credit ETFs such as the BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF (Ticker: ZSU) on the short end of the curve. Complement this with long-term government bond exposure through ETFs, such as the BMO Long-Term US Treasury Bond Index ETF (Ticker: ZTL).

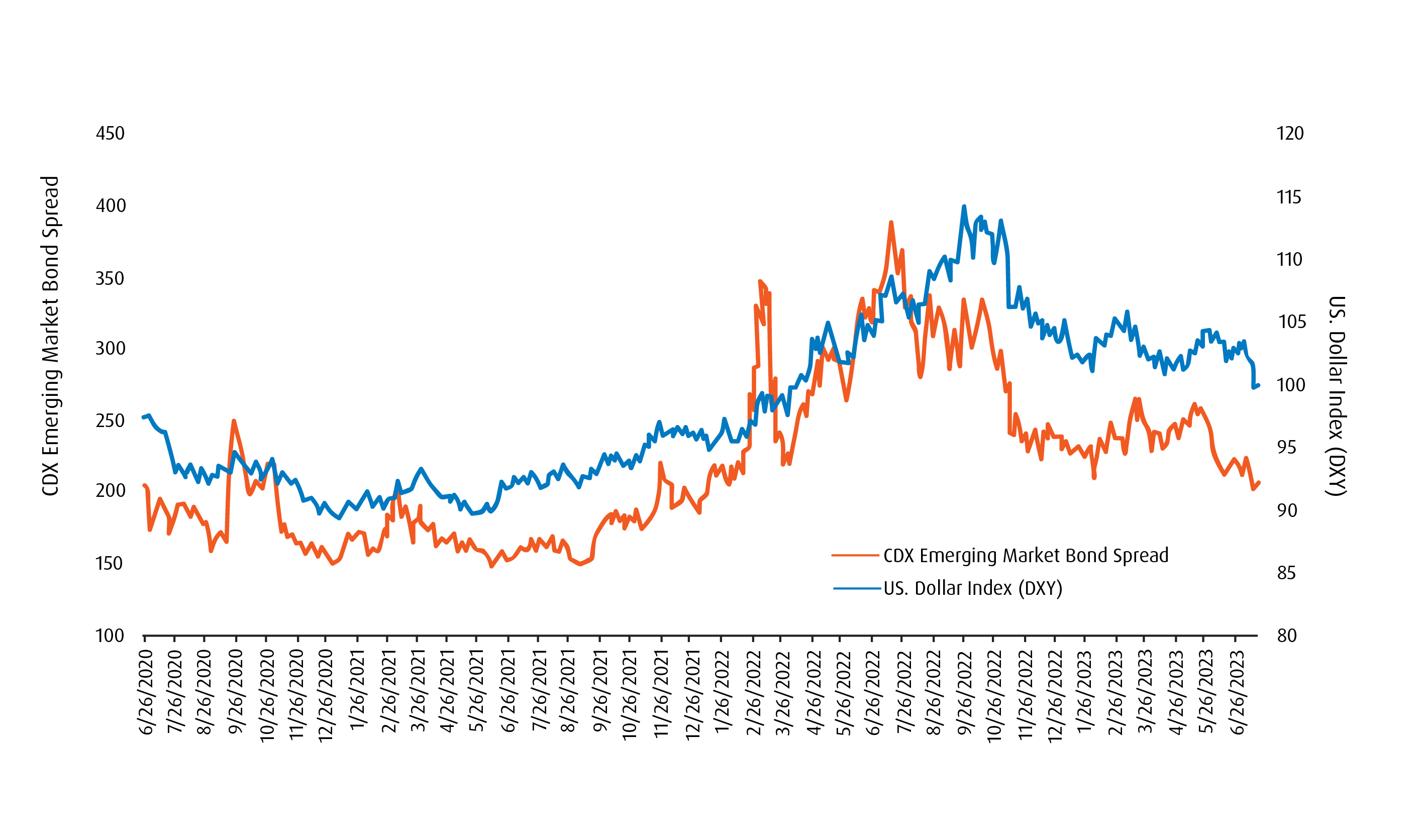

The U.S. dollar (USD) has been a focus for investors for many reasons. The Fed pausing its interest rate hikes and, thus, shifting toward a more data-dependent policy has been one factor. After surging in 2022 on the back of the Fed’s aggressive rate hiking cycle, it has fallen –12.6% since its peak last year.1 Besides the Fed taking more of a reactive stance to fight inflation, growing talks of “de-dollarization” have also risen. As global financial infrastructure is built on the greenback as the world’s reserve currency, it will take decades to move away from the USD. However, a growing number of countries are using their currencies to settle trade. The most notable example is the BRICS nations (Brazil, Russia, India, China and South Africa) working to establish a unified currency backed by gold.

Recommendation: A weakening USD will be interesting to watch on several fronts. Since last fall, we’ve been expecting inflation to dissipate in 2023. While we can’t declare victory yet, there are signs we are trending in the right direction. However, one key concern is the impact of a lower USD on inflation. With the U.S. being an importer of goods, the Fed must ensure a weaker currency does not reignite inflation. Credit spreads in emerging market debt have also tightened as a weaker USD has made debt repayment a greater probability. While our preferred bond exposure is investment grade corporate bonds, it will be interesting to see how exposures, such as the BMO Emerging Markets Bond Hedged to CAD Index ETF (Ticker: ZEF), react to a weakening USD.

After a downright abysmal year in 2022, economic projections were revised downwards, which made a lower hurdle for data to come in better than economists’ expectations. With a string of positive surprises, expectations have now been revised higher, which may lead to some downside surprises, and may weigh on the market in the second half. While we are cautiously optimistic, growing geo-political risk investors may want to take some risk off the table.

Recommendation: Coming into the year, we expected the quality factor to outperform, and it has been off to a great start. At our BMO ETF Economic Forum in February, we highlighted how low volatility would play a more important role in the second half. We continue to believe in pairing low volatility ETFs, such as the BMO Low Volatility US Equity ETF (Ticker: ZLU), with the BMO MSCI USA High Quality Index ETF (Ticker: ZUQ). Both these exposures tend to be defensively oriented in case economic data begins to disappoint; however, they can be very complementary in terms of their tilts toward factor exposures.

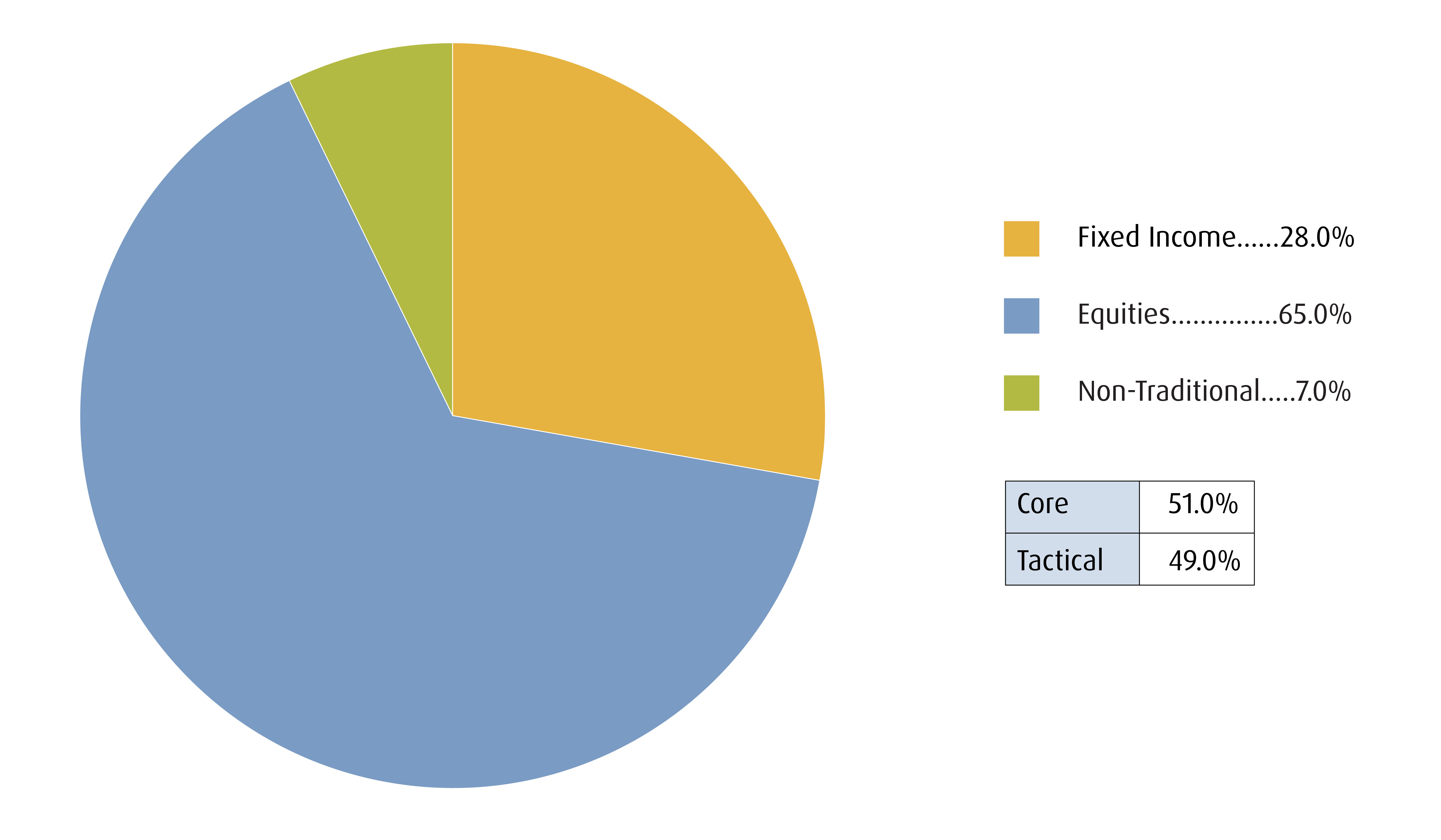

The strategy involves tactically allocating to multiple asset-classes and geographies to achieve long-term capital appreciation and total return by investing primarily in ETFs.

| Ticker | ETF Name | Sector | Positioning | Price | Management Fee* | Weight (%) | 90-Day Vol | Volatility Contribution | Yield(%) | Yield/Vol** |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed Income | ||||||||||

| ZDB | BMO Discount Bond Index ETF | Fixed Income | Core | $14.31 | 0.09% | 9.0% | 8.4 | 7.5% | 2.5% | 0.30 |

| ZSU | BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF | Fixed Income | Tactical | $12.99 | 0.25% | 7.0% | 4.4 | 3.0% | 3.2% | 0.74 |

| ZTIP.F | BMO Short-Term US TIPS Index ETF (Hedged Units) | Fixed Income | Tactical | $28.11 | 0.15% | 5.0% | 3.3 | 1.6% | 5.1% | 1.58 |

| ZTL | BMO Long-Term US Treasury Bond Index ETF | Fixed Income | Tactical | $40.15 | 0.20% | 5.0% | 9.3 | 4.6% | 3.5% | 0.37 |

| ZST | BMO Ultra Short-Term Bond ETF | Fixed Income | Tactical | $48.67 | 0.30% | 2.0% | 1.5 | 0.3% | 4.7% | 3.17 |

| Total Fixed Income | 28.0% | 16.9% | ||||||||

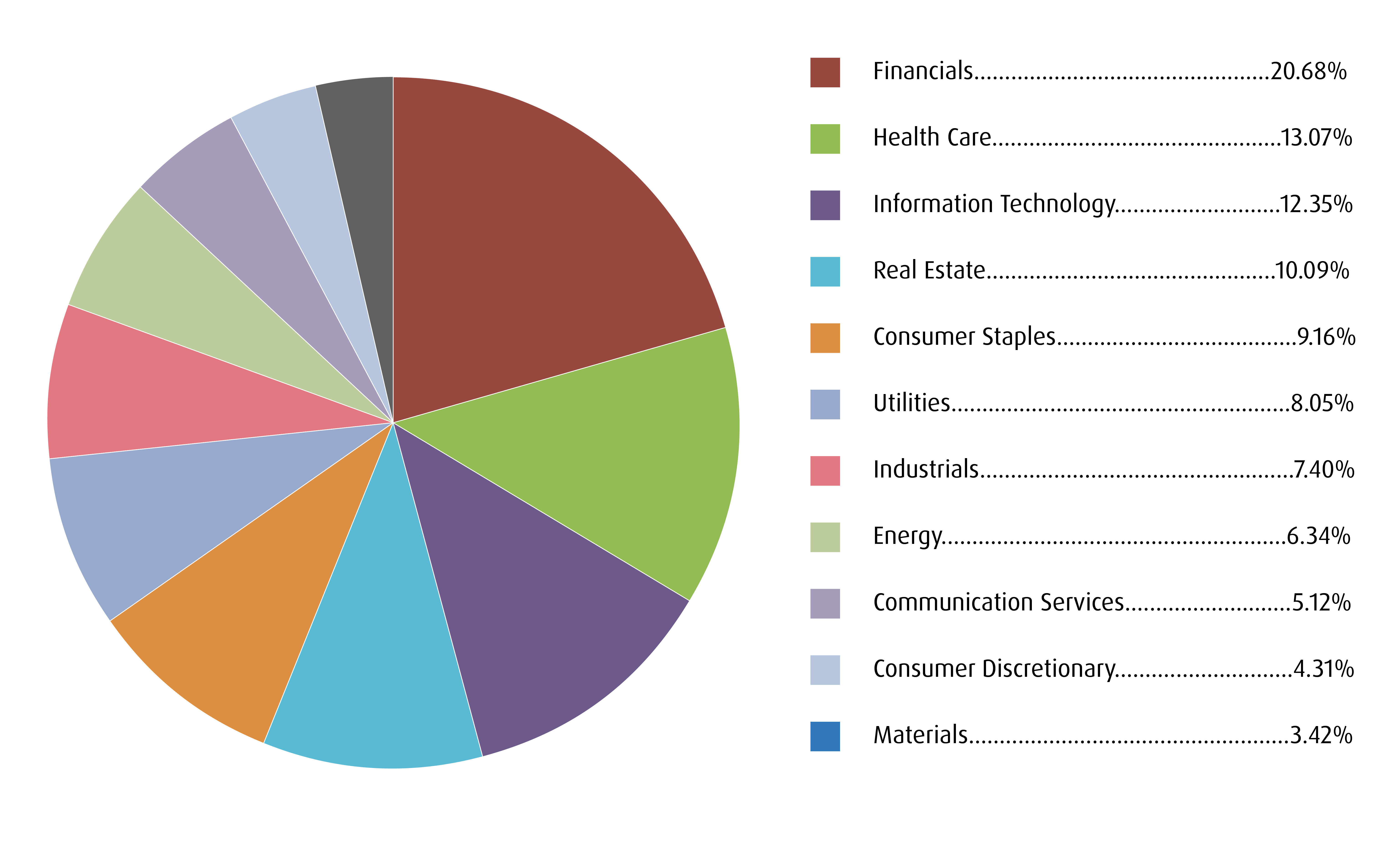

| Equities | ||||||||||

| ZLB | BMO Low Volatility Canadian Equity ETF | Equity | Core | $41.48 | 0.35% | 17.0% | 8.1 | 13.5% | 2.7% | 0.33 |

| ZRE | BMO Equal Weight REITs Index ETF | Equity | Tactical | $21.40 | 0.05% | 4.0% | 14.1 | 5.6% | 5.0% | 0.36 |

| ZLU | BMO Low Volatility US Equity ETF | Equity | Core | $46.16 | 0.30% | 8.0% | 10.2 | 8.0% | 2.3% | 0.23 |

| ZLD | BMO Low Volatility International Equity Hedged to CAD ETF | Equity | Core | $24.84 | 0.40% | 7.0% | 10.9 | 7.5% | 2.7% | 0.25 |

| ZEO | BMO Equal Weight Oil & Gas Index ETF | Equity | Tactical | $58.53 | 0.55% | 4.0% | 21.6 | 8.5% | 5.1% | 0.24 |

| ZUH | BMO Equal Weight US Health Care Hedged to CAD Index ETF | Equity | Tactical | $70.10 | 0.35% | 4.0% | 13.1 | 5.1% | 0.4% | 0.03 |

| ZEB | BMO Equal Weight Banks Index ETF | Equity | Tactical | $34.07 | 0.55% | 8.0% | 15.3 | 12.1% | 4.9% | 0.32 |

| ZUQ | BMO MSCI USA High Quality Index ETF | Equity | Core | $61.53 | 0.30% | 10.0% | 13.6 | 13.3% | 1.0% | 0.07 |

| ZWT | BMO Covered Call Technology ETF | Equity | Tactical | $33.37 | 0.65% | 3.0% | 17.1 | 5.0% | 4.0% | 0.23 |

| Total Equity | 65.0% | 78.6% | ||||||||

| Non-Traditional Hybrids | ||||||||||

| ZPR | BMO Laddered Preferred Share Index ETF | Hybrid | Tactical | $8.80 | 0.45% | 3.0% | 10.4 | 3.1% | 6.1% | 0.59 |

| ZBI | BMO Canadian Bank Income Index ETF | Hybrid | Tactical | $27.16 | 0.25% | 4.0% | 3.5 | 1.4% | 3.4% | 0.97 |

| Total Alternatives | 7.0% | 4.4% | ||||||||

| Total Cash | 0.0% | 0.0 | 0.0% | 0.0% | ||||||

| Portfolio | 0.32% | 100.0% | 10.2% | 100.0% | 3.2% | 0.31 | ||||

Source: Bloomberg, BMO Asset Management Inc., as of July 17, 2023. *Management Fee as of July 17, 2023. ** Yield calculations for bonds are based on yield to maturity, including coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity and. For equities, it is based on the most recent annualized income received divided by the market value of the investments. Please note yields of equities will change from month to month based on market conditions. The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

| Ticker | Name | Weight |

|---|---|---|

| ZLB | BMO LOW VOLATILITY CANADIAN EQUITY ETF | 17.0% |

| ZUQ | BMO MSCI USA HIGH QUALITY INDEX ETF | 10.0% |

| ZDB | BMO DISCOUNT BOND INDEX ETF | 9.0% |

| ZLU | BMO LOW VOLATILITY US EQUITY ETF | 8.0% |

| ZEB | BMO EQUAL WEIGHT BANKS INDEX ETF | 8.0% |

| ZSU | BMO SHORT-TERM US IG CORPORATE BOND HEDGED TO CAD INDEX ETF | 7.0% |

| ZLD | BMO LOW VOLATILITY INTERNATIONAL EQUITY HEDGED TO CAD ETF | 7.0% |

| ZTIP.F | BMO SHORT-TERM US TIPS INDEX ETF (HEDGED UNITS) | 5.0% |

| ZTL | BMO LONG-TERM US TREASURY BOND INDEX ETF | 5.0% |

| ZRE | BMO EQUAL WEIGHT REITS INDEX ETF | 4.0% |

| ZEO | BMO EQUAL WEIGHT OIL & GAS INDEX ETF | 4.0% |

| ZUH | BMO EQUAL WEIGHT US HEALTH CARE HEDGED TO CAD INDEX ETF | 4.0% |

| ZBI | BMO CANADIAN BANK INCOME INDEX ETF | 4.0% |

| ZWT | BMO COVERED CALL TECHNOLOGY ETF | 3.0% |

| ZPR | BMO LADDERED PREFERRED SHARE INDEX ETF | 3.0% |

| ZST | BMO ULTRA SHORT-TERM BOND ETF | 2.0% |

| Total | 100.0% |

| Federal | 48.4% | Weighted Average Term | 12.01 |

| Provincial | 14.2% | Weighted Average Duration | 6.68 |

| Investment Grade Corporate | 37.4% | Weighted Average Coupon | 2.21% |

| Non-Investment Grade Corporate | 0.0% | Weighted Average Current Yield | 2.26% |

| Weighted Average Yield to Maturity | 3.78% |

Weighted Average Term: The average interest received by a bond investor, expressed on a nominal annual basis.

Weighted Average Current Yield: The market value-weighted average coupon divided by the weighted average market price of bonds.

Weighted Average Yield to Maturity: The market value-weighted average yield to maturity includes coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

Weighted Average Duration: The market value-weighted average duration of underlying bonds divided by the weighted average market price of the underlying bonds. Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates.

Weighted Average Coupon: The average time it takes for bonds to mature in a fixed income portfolio.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Source: Bloomberg, BMO Global Asset Management, as of July 17, 2023.

Visit bmo.com/etfs or contact Client Services at 1−800−361−1392.

To listen to our Views From the Desk BMO ETF Podcasts, please visit bmoetfs.ca.

BMO ETF Podcasts are also available on

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

Yield curve: A line that plots the interest rates of bonds having equal credit quality but differing maturity dates. A normal or steep yield curve indicates that long-term interest rates are higher than short-term interest rates. A flat yield curve indicates that short-term rates are in line with long-term rates, whereas an inverted yield curve indicates that short-term rates are higher than long-term rates.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the individuals represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The ETFs referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

This podcast presentation is for informational purposes only. No part of this presentation may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, recording or otherwise, without the written permission of BMO Investments Inc. or BMO Asset Management Inc. (collectively, BMO GAM) ).

For greater certainty, no part of this presentation may be provided to investors and/or potential investors without the written permission of BMO GAM. The information contained herein is not, and should not be construed as, investment advice and or tax advice to any individual. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. This communication is intended for information purposes only. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. BMO GAM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. BMO ETFs and ETF Series trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence.

Copyright © 2022 Prosper Experiential Media. All rights reserved. | Privacy Policy | Terms & Conditions