While inflation was sidelined by several central banks and deemed as “transitory” for the most part during 2021, the tone shifted promptly this year as back-to-back red-hot inflation prints forced most central banks to go on an interest-rate hiking spree. This aggressive action is being taken to tame inflation otherwise known as the rate of change in prices over time, [1], as it’s persistently high and is eroding the purchasing power of households, reducing consumer spending, and the overall economic well-being.

What are the causes of inflation?

Before we discuss whether inflation will slow down or not, let’s take a step back and analyze what’s causing prices to rise globally in the first place. Most economists attribute this uptick in inflation to several different causes such as:

- Cost-push inflation driven by supply chain crisis

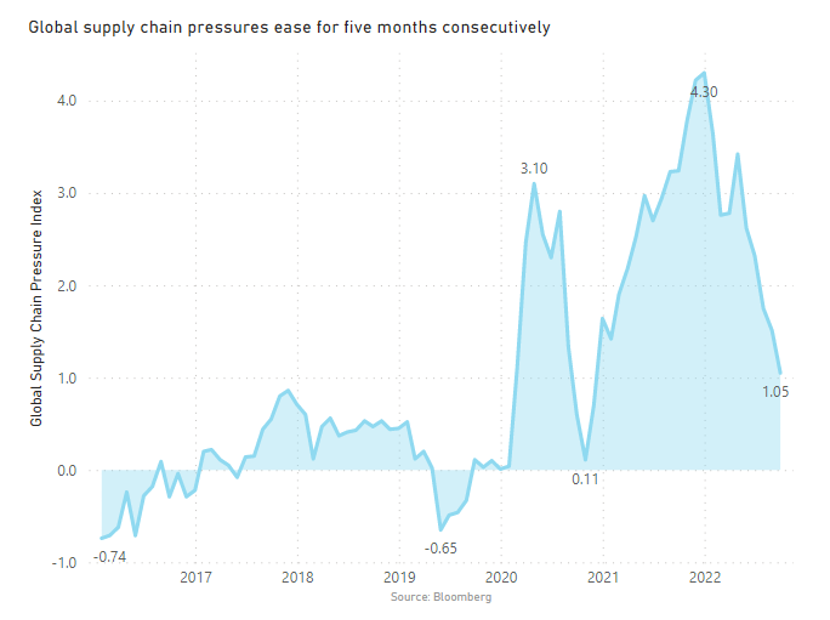

The COVID-19 outbreak led to a series of lockdowns and restrictions across the globe, which caused supply chain disruptions and labour shortages and ultimately induced cost-push inflation [2], resulting in a surge of prices due to an increase in costs of producing and supplying products and services. World economies are still recovering from this effect, and some of these constraints are fading away as global transportation costs plunge and Chinese production ramps up again. However, the Russian invasion of Ukraine is clearly hampering this progress and further stoking inflation. [3]

- Demand-pull inflation fueled by savings, fiscal stimulus, and monetary policy

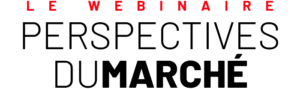

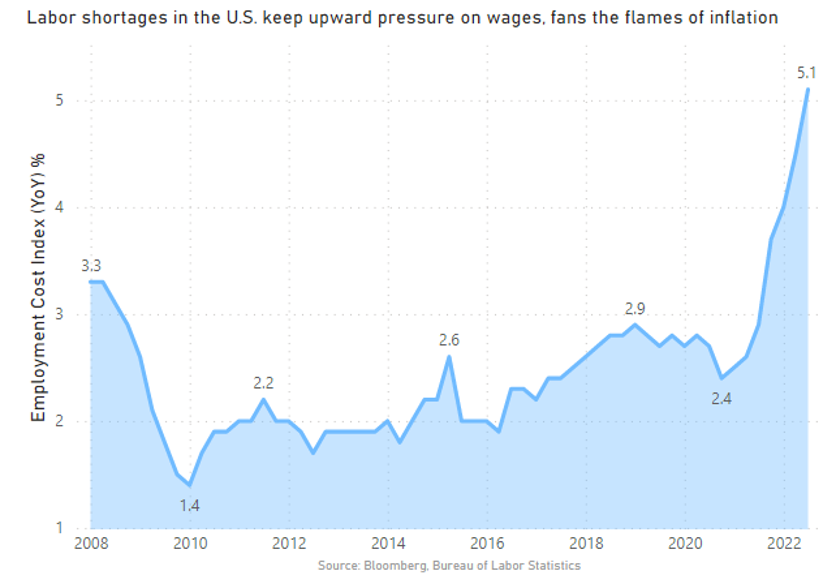

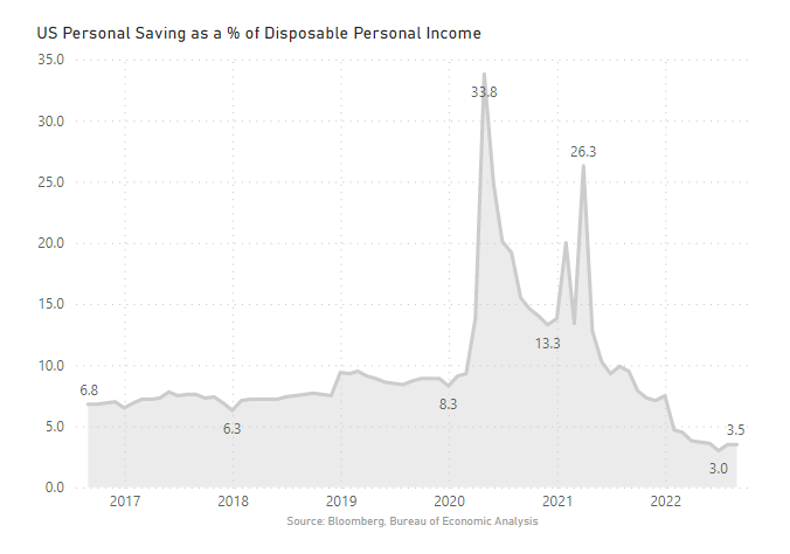

The pandemic had caused an unconventional recession, and to keep economies afloat, several central banks slashed their interest rates, increased their money supply M2 (a measure of the money supply that includes cash, checking deposits, and easily- convertible near money)., gave out government aid, relief, & stimulus payments as part of the fiscal response during 2020 & 2021. As businesses reopen this year after remaining shuttered and reducing their production and services, they could not meet the pent-up demand driven by savings accumulated during the pandemic along with the monetary & fiscal stimulus. Thus, strong consumer demand, fueled by robust growth in employment, has outstripped supply temporarily for several products & services such as air travel, hotels, cars, etc., resulting in demand-pull inflation [4].

A series of interest rate hikes to curb sky-high inflation

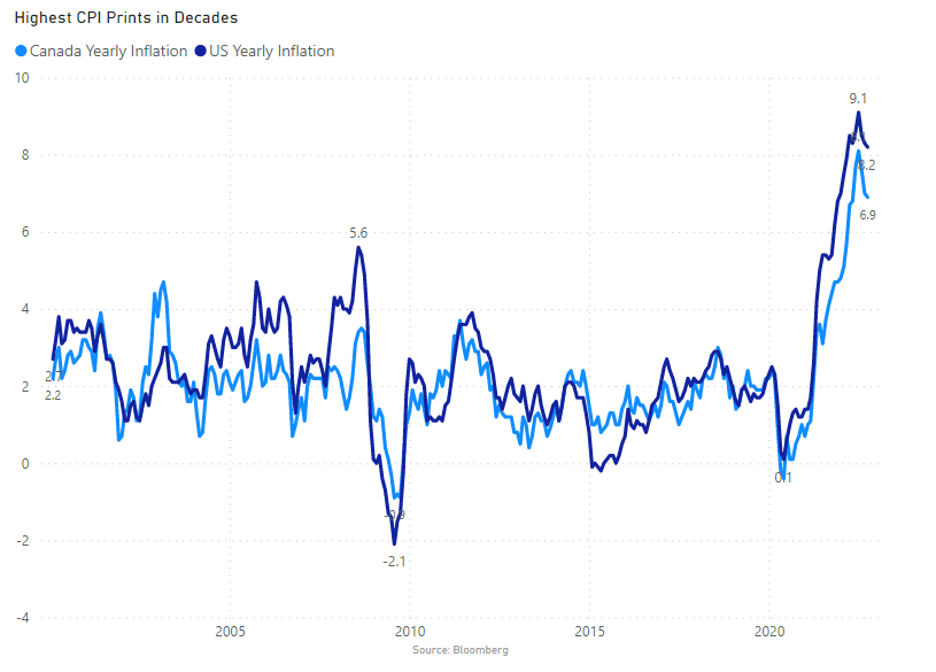

The price increases for gasoline, food, and housing caused Canada’s inflation to rise to a 39-year high of 8.1% in June 2022. The markets got some respite in August as headline inflation came down to 7% and further weakened in September to 6.9% from a year ago, as gasoline prices fell. However, the recent data was disappointing as the dramatic increase in food prices was unexpected.

On a similar note, south of the border, the U.S. inflation spiked to 9.1% in June 2022, the highest level since 1981. Although headline U.S. inflation reported for September was up by 8.2% from a year earlier (down from the peak of June 2022), the core U.S. consumer price index (ex. food & energy) rose to a 40-year high, increasing to 6.6% from a year ago, which is a cause of concern as its squeezing households by outpacing the growth in wages.

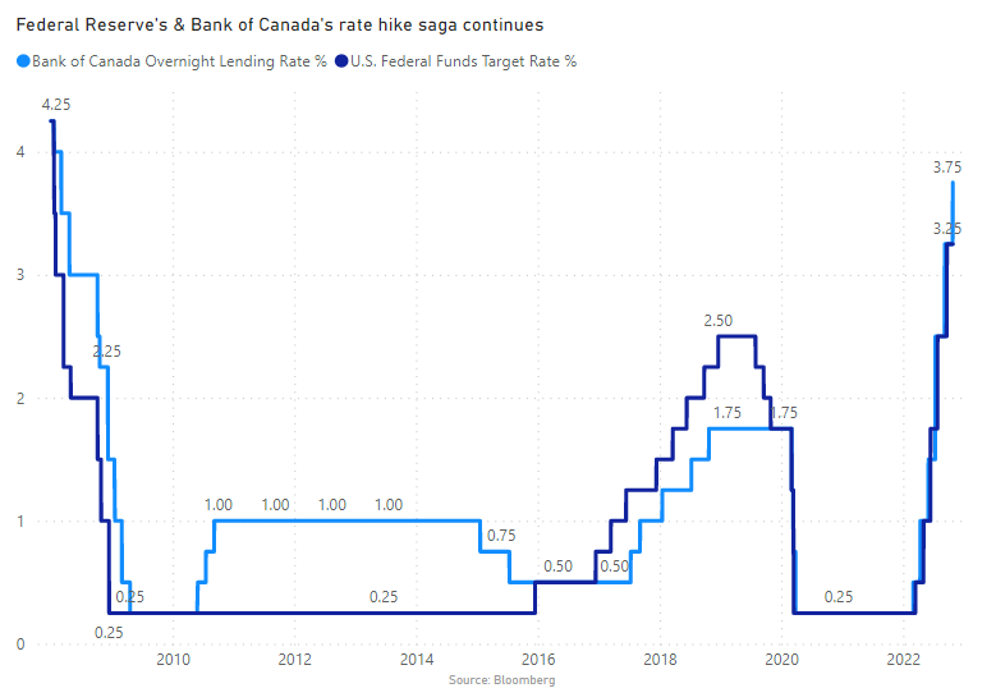

To dial down the surge in prices, the Federal Reserve engaged in a series of rate hikes not seen since the late 1980s, increasing the front-end interest rate to 3.25% in September. The Bank of Canada followed suit by raising rates through consecutive outsized hikes, bringing its target overnight rate to 3.75% in October. Given inflation is still sky-high in both countries and way above their 2% target, both Fed & Boc are expected to raise their short-term rates again. Both central banks are maintaining their hawkish tones, which means the rates will be further raised to fight against raging inflation. However, they may dial back the pace of their hikes amid recession fears.

To dial down the surge in prices, the Federal Reserve engaged in a series of rate hikes not seen since the late 1980s, increasing the front-end interest rate to 3.25% in September. The Bank of Canada followed suit by raising rates through consecutive outsized hikes, bringing its target overnight rate to 3.75% in October. Given inflation is still sky-high in both countries and way above their 2% target, both Fed & Boc are expected to raise their short-term rates again. Both central banks are maintaining their hawkish tones, which means the rates will be further raised to fight against raging inflation. However, they may dial back the pace of their hikes amid recession fears.

When will we see a slow down in inflation?

Looking at recent CPI prints, the question arises if the U.S. & Canada have passed peak inflation. The truth is it’s hard to predict what lies ahead. Prices in some sectors, such as gas and used automobiles, have dropped, which is a good sign. However, prices for certain goods & services are “stickier” than others, such as rent, insurance, health care or dining out, meaning that they are likely to stay at their current levels or increase even further, so inflation may stick around for a while. Moreover, higher wages and inflation may continuously feed into each other, resulting in a wage-price spiral [5] which may result in further rate hikes, causing additional damage.

Nonetheless, there is light at the end of the tunnel as some economists expect inflation to start cooling if the pandemic slows down and the Russia/Ukraine conflict ends [6]. Morningstar forecasts inflation to remain high for the rest of 2022 but predicts that combined with the effect of interest rate hikes, prices will fall during 2023 and thereafter as supply chains heal and demand normalizes [7].

How to address inflation in your portfolio?

There are various Canadian listed ETFs that can be used for inflation protection.

Fixed Income:

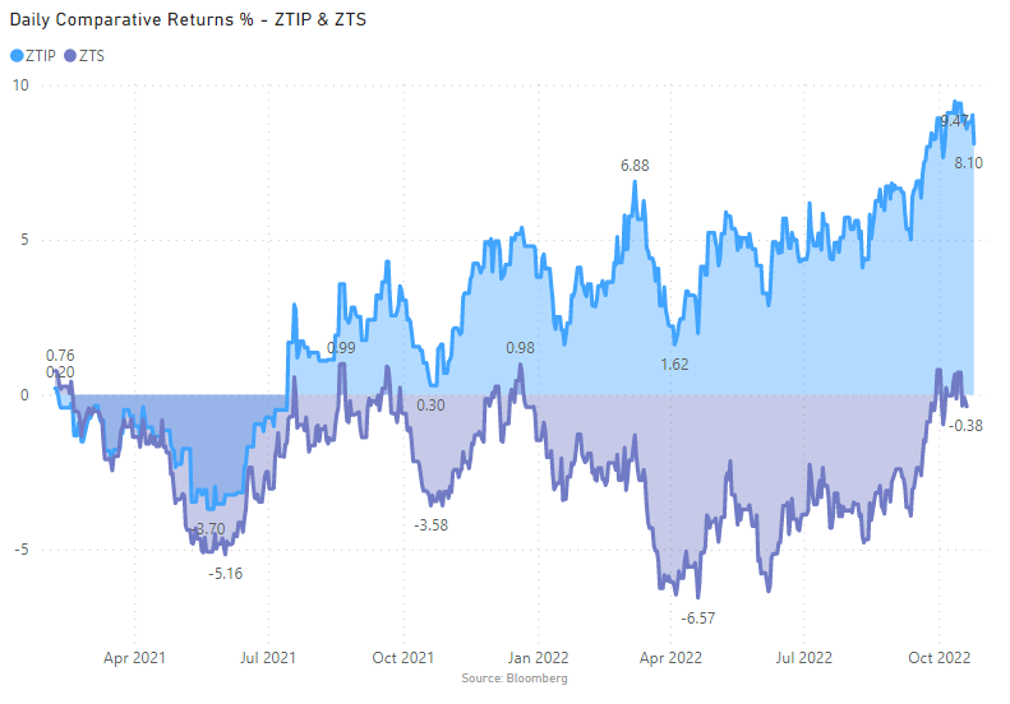

BMO Short-Term US TIPS Index ETF (ZTIP) tracks the performance of U.S government inflation-linked bonds index, comprising of 0-5yr US Treasury Inflation Protected Securities (TIPS). ZTIP offers inflation protection with minimal duration risk. ZTIP is also offered as hedged to CAD (ZTIP.F) and in USD (ZTIP.U).

The chart below shows that ZTIP outperformed a traditional U.S. treasury bond ETF, BMO Short-Term US Treasury Bond Index ETF (ZTS) during the current inflationary environment.

Equities:

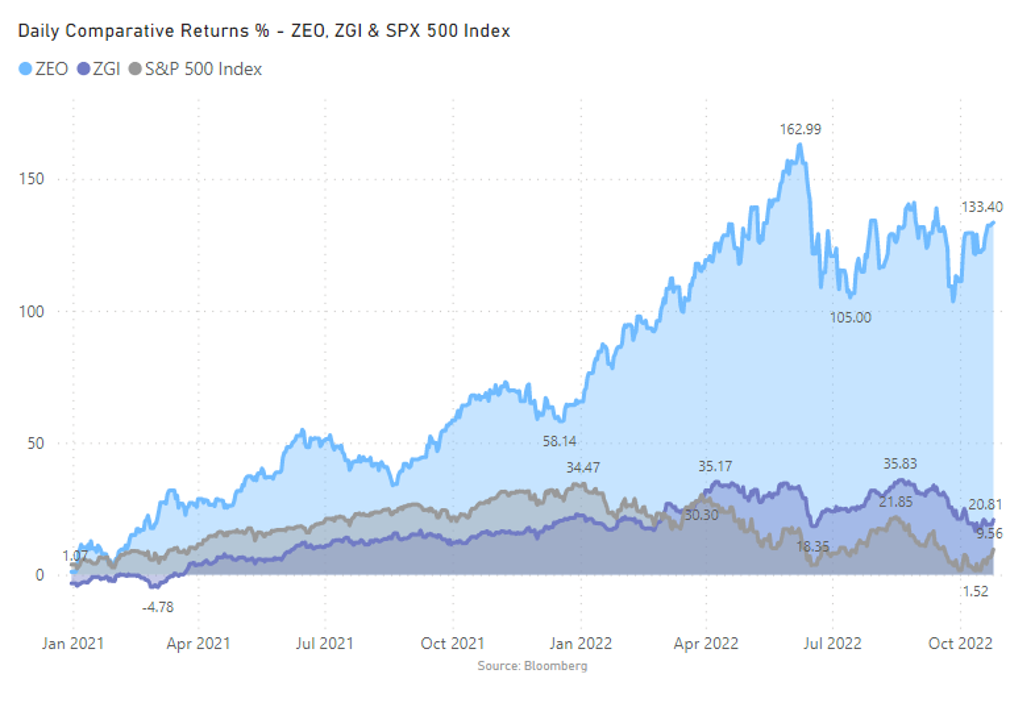

BMO Global Infrastructure Index ETF (ZGI) provides exposure to hard assets by investing in companies such as airports, cell phone towers, pipelines, water plants etc. These hard assets generally hold their value in an inflationary environment as some of these companies have revenues indexed with inflation. Moreover, infrastructure companies tend to have longer-term contracts and may see increase an in contracts as government funding is often focused on infrastructure projects.

BMO Equal Weight Oil & Gas Index ETF (ZEO) provides exposure to the Canadian energy sector while mitigating company specific risk through equal weighting. Most commodities act as a natural hedge against inflation as they are priced in real terms. As economies bounce back, the demand for oil & gas has outpaced supply and prices have increased along with inflation, showing they can be used as a hedge against it.

The chart below illustrates the comparative returns of ZEO & ZGI versus S&P 500 and shows that hard assets such as infrastructure, oil & gas can outperform other sectors during periods of high inflation.

Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

| Name | Ticker | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Inception | Inception Date |

| BMO Short-Term US TIPs Index ETF | ZTIP | -3.26% | 0.13% | January 20, 2021 | |||

| BMO Short-Term US Treasury Bond Index ETF | ZTS | 1.20% | 0.10% | 2.19% | 0.89% | February 28, 2017 | |

| BMO Equal Weight Oil & Gas Index ETF | ZEO | 34.13% | 16.60% | 4.39% | -0.13% | -0.34% | October 20, 2009 |

| BMO Global Infrastructure Index ETF | ZGI | 8.85% | 12.49% | 6.85% | 10.32% | 11.45% | January 19, 2010 |

Source: BMO GAM, Sept 30, 2022

Citations:

- https://www.imf.org/external/pubs/ft/fandd/basics/30-inflation.htm

- https://www.forbes.com/advisor/investing/cost-push-inflation/

- https://www2.deloitte.com/uk/en/insights/economy/russia-ukraine-war-inflation-impact.html

- https://www.forbes.com/advisor/investing/demand-pull-inflation/

- https://www.imf.org/en/Blogs/Articles/2022/10/05/wage-price-spiral-risks-appear-contained-despite-high-inflation

- https://time.com/nextadvisor/investing/expert-say-how-long-will-take-inflation-to-come-down/

- https://www.morningstar.ca/ca/news/226419/why-we-expect-inflation-to-fall-in-2023.aspx#:~:text=Combined%20with%20the%20effect%20of,above%20the%20Fed’s%202%25%20target

DISCLAIMER:

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.